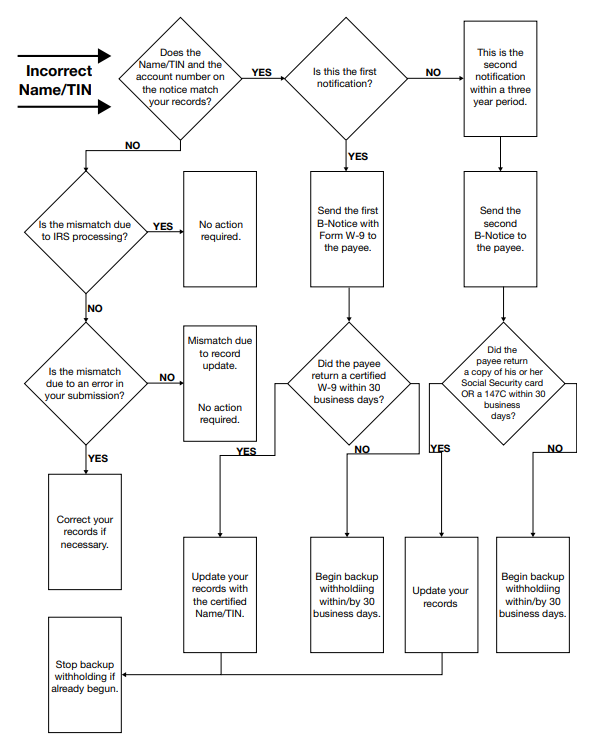

Glossary: Backup Withholding

What to Do if You Don’t Have a Social Security Number

| IF | THEN |

|---|---|

| The last name and SSN on your account agree with the last name and SSN on your social security card | Contact your local SSA office to ascertain whether the information on SSA’s records is different from that on your social security card, and to resolve any problem. Also, put your name and SSN on the enclosed Form W-9 following the instructions on the form. Sign the Form W-9 and send it to us. |

| The SSN on your account is different from the SSN on your social security card, but the last name is the same | Put your name and SSN, as shown on your social security card, on the enclosed Form W-9, following the instructions on the form, sign it, and send it to us. You do not need to contact SSA. |

| The last name on your account is different from the last name on your social security card, but the SSN is the same on both | Take one of the following steps (but not both):

|

| Both the last name and SSN on your account are different from the last name and SSN on your social security card | Take one of the following steps (but not both):

|

Table Retrieved From: https://www.irs.gov/pub/irs-pdf/p1281.pdf

What is Backup Withholding?

Backup withholding is a form of tax withholding on income payments to individuals where the payer deducts and withholds income tax from the earnings at the time of payment. Governed under the Internal Revenue Code, particularly Section 3406, backup withholding ensures tax collection from payments that might otherwise go unreported to the IRS. The mechanism is used for payments not typically subject to regular withholding, such as interest, dividends, and non-employee compensation.

The legal foundation for backup withholding obligates payers, such as financial institutions and businesses, to deduct and withhold a percentage of payments under certain conditions. These conditions primarily relate to the information provided by the payee (the person receiving the payments), such as the taxpayer identification number (TIN), which includes Social Security Numbers (SSNs), Employer Identification Numbers (EINs), and Individual Taxpayer Identification Numbers (ITINs).

Circumstances Leading to Backup Withholding

Backup withholding can be initiated under several circumstances, primarily revolving around the submission of incorrect or inadequate taxpayer information by the payee. Here are some key scenarios:

- Incorrect TIN Provided: If the payee fails to provide a TIN, provides an incorrect TIN, or the TIN does not match IRS records, the payer is required to initiate backup withholding.

- Underreported Income: If the IRS determines that a payee has underreported interest or dividend income as reflected by discrepancies between their tax returns and the information forms (like Forms 1099), backup withholding may be applied. This is to ensure that the IRS collects the appropriate amount of taxes on all income.

- Failure to Certify Non-Withholding Status: When opening a new account or entering into other transactions that require a Form 1099, if the payee fails to certify, under penalty of perjury, that they are not subject to backup withholding, the payer must withhold taxes.

- IRS Notification: If the IRS specifically notifies a payer that backup withholding should begin due to any of the above issues, the payer must comply by starting to withhold taxes from the payee’s payments.

Current Rate of Backup Withholding

As of the latest guidelines, the rate for backup withholding is set at 24%. This rate was established to align with the changes in the tax brackets and rates set forth by recent tax reforms. This 24% rate applies uniformly across all types of payments subject to backup withholding, which simplifies the withholding process for payers and ensures a consistent approach to collecting taxes on potentially underreported or unreported income.

Payments Subject to Backup Withholding

Backup withholding is a precautionary tax measure enforced on certain types of payments when specific conditions are met, such as failure to provide a valid taxpayer identification number or underreporting of income. Here, we explore the range of payments that may trigger backup withholding to help taxpayers and businesses understand their obligations and ensure compliance with IRS requirements.

General Types of Payments

Several categories of payments can be subject to backup withholding if the payee does not meet certain tax obligations. These generally include:

- Interest Payments: Payments of interest from various sources such as banks, credit unions, or savings and loans.

- Dividends and Distributions: Income from dividends provided by corporations and distributions from mutual funds.

- Independent Contractor Payments: Compensation for services provided by non-employees, including freelancers and consultants.

- Miscellaneous Incomes: This broad category includes various types of payments such as rents, royalties, awards, and other compensations.

- Gambling Winnings: Earnings from gambling which are not covered by regular gambling tax withholdings.

Detailed List of Payments

To provide clarity, below is a detailed explanation of each type of payment that may be subject to backup withholding:

Interest Payments (Form 1099-INT)

- Description: This form is used to report interest income earned from bank accounts, certificates of deposit, savings and loan institutions, and other similar investments.

- Common Sources: Banks, credit unions, and financial institutions.

- Why Subject to Withholding: Often withheld when a taxpayer’s identification number is incorrect or missing on their account.

Dividends and Distributions (Form 1099-DIV)

- Description: Form 1099-DIV reports dividends and other distributions received during the fiscal year from investments in stocks and mutual funds.

- Common Sources: Corporations and mutual funds.

- Why Subject to Withholding: Withholding occurs if there is underreported income or an incorrect TIN.

Independent Contractor Payments (Form 1099-NEC)

- Description: This form is for reporting payments made to non-employees, such as freelancers and independent contractors, for services rendered.

- Common Uses: Used by businesses paying non-employee compensation exceeding $600 in a year.

- Why Subject to Withholding: Required when the contractor does not provide a TIN or if the IRS notifies the payer of an incorrect TIN.

Miscellaneous Incomes (Form 1099-MISC)

- Description: Used to report payments for rents, royalties, prizes and awards, and other fixed or determinable gains, profits, and income.

- Common Uses: Landlords receiving rent, artists receiving royalties, and others receiving various forms of non-employee income.

- Why Subject to Withholding: Backup withholding applies if the payee fails to furnish a correct TIN.

- Description: This form is used to report gambling winnings and any federal income tax withheld on those winnings.

- Common Sources: Casinos, lottery commissions, and other gaming establishments.

- Why Subject to Withholding: Gambling winnings are subject to backup withholding if the winner does not provide a TIN or the IRS has notified the payer of underreported income.

For the complete list visit: https://www.irs.gov/taxtopics/tc307

How to Prevent or Stop Backup Withholding

Backup withholding is a mechanism by which the IRS ensures tax compliance on income that might otherwise go underreported. However, it can be inconvenient for taxpayers subject to it, reducing the cash flow from payments such as interest, dividends, or independent contractor income. Understanding how to prevent or stop backup withholding is crucial for maintaining financial efficiency and tax compliance.

Providing Correct Information

One of the most common reasons for backup withholding is the provision of incorrect taxpayer identification information. Here are the steps to correct this and prevent or stop backup withholding:

Review Your Information: Verify the accuracy of your taxpayer identification number (TIN), which could be your Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN) on all financial documents and with any entities that pay you through mechanisms requiring IRS reporting (like 1099 forms).

Submit Updated Information: If you discover that incorrect information was used, promptly provide the correct details to your payer. This often involves filling out a Form W-9, Request for Taxpayer Identification Number and Certification, where you’ll declare under penalty of perjury that the TIN you are providing is correct.

Respond to IRS Notices: If you receive an IRS notice indicating that your TIN is incorrect, respond immediately with the correct information, and follow any additional instructions provided by the IRS to rectify the situation.

Regularly Update Records: Maintain updated records with all entities you receive payments from, especially if you recently had a change in your TIN or personal details such as your name or address.

Resolving Underreported Income

Backup withholding can also be triggered by underreported income on your tax returns. To address this issue, follow these steps:

Review Past Returns: Examine your previous tax returns to check for any discrepancies in reported income, particularly from sources like dividends and interest.

Amend Incorrect Returns: If you find errors, file an amended tax return using Form 1040-X, Amended U.S. Individual Income Tax Return. This will correct any underreported amounts and show the IRS that you are taking steps to comply with tax laws.

Pay Owed Taxes: If amending your return results in additional tax owed, pay this amount promptly to avoid further penalties and interest. This payment will demonstrate your intent to resolve compliance issues, which is critical in stopping backup withholding.

Filing Past Returns

Sometimes, backup withholding begins because of unfiled tax returns. Here’s how to address this issue:

Identify Missing Returns: Determine which tax years require filings by reviewing your records or consulting with the IRS. You can request your tax transcript to see what information the IRS has on file regarding your past filings.

Prepare and File Returns: Complete the required returns as accurately as possible. If you lack information such as W-2s or 1099s, request duplicates from your employers or payers, or use the IRS’s “Get Transcript” service to obtain wage and income transcripts.

Consult a Tax Professional: If you’re unsure how to proceed with filing past returns, consider consulting a tax professional who can provide guidance tailored to your situation, ensuring compliance and minimizing potential penalties.

Credit for Backup Withholding

Backup withholding reduces the immediate cash flow from various income sources but is not lost money; it is a prepayment of the income tax you might owe. Understanding how to credit this withholding and its impact on different tax entities like partnerships and S corporations is crucial for accurate financial and tax planning.

Reporting Withheld Amounts

When backup withholding is applied to your income, it is essential to correctly report these amounts on your tax return to credit against any tax owed. Here’s how to properly report these amounts:

Locate Withholding Information: Find the total amount of backup withholding for the year from your Form 1099s or W-2G forms. Each form should state the amount of income paid to you and the amount of tax withheld.

Report on Income Tax Return: On your personal tax return (Form 1040 or 1040-SR), report the total amount withheld as federal income tax withheld. It goes on the line specified for total withholding, which includes amounts withheld from W-2 forms (wages) and all Forms 1099.

Adjust Tax Owed: The amount reported as withheld acts as a credit against the income tax owed for the year. If the total withholding (including backup withholding) exceeds your tax liability, you may be due a refund.

Documentation: Keep all related Forms 1099 and W-2G as part of your tax records. If there are discrepancies between your records and the information provided to the IRS by payers, these documents will be crucial for resolving any issues.

Impact on Partnerships and S Corporations

For partnerships and S corporations, the process for reporting backup withholding involves additional steps as these entities generally do not pay income tax at the corporate level. Instead, income and tax obligations pass through to the individual partners or shareholders. Here’s how backup withholding is handled:

Reporting to Partners and Shareholders: If backup withholding is applied on income belonging to a partnership or S corporation, the entity must report the withheld amounts to the respective partners or shareholders. This is typically done through Schedule K-1, which details each partner’s or shareholder’s share of income and withholdings.

Individual Tax Returns: Partners and shareholders must then report their share of the income and the backup withholding on their personal tax returns. Like individual taxpayers, they can credit the withheld amount against their total tax liability.

No Refund to Entity: It is important to note that any amount withheld under backup withholding is not refundable to the partnership or S corporation itself. Instead, the credit only benefits the individual partners or shareholders when they file their personal tax returns.

Documentation and Compliance: Both partnerships and S corporations should keep thorough records of all amounts withheld and reported to partners and shareholders. These records are essential for ensuring compliance with IRS rules and for resolving any discrepancies that may arise with individual tax returns.

Payments Excluded from Backup Withholding

While backup withholding applies to a wide array of income types, there are specific payments that the IRS exempts from this process. Understanding these exemptions and the criteria under which they apply can help taxpayers manage their finances more effectively, ensuring that they are neither unnecessarily withheld nor incorrectly reported.

Specific Exemptions

There are several types of payments that are specifically exempt from backup withholding, regardless of the taxpayer’s compliance status with the IRS. These exemptions include:

Real Estate Transactions: Proceeds from the sale of real estate are typically not subject to backup withholding. However, other related payments like rental income might be, unless exempted under other provisions.

Retirement Account Distributions: Payments from qualified retirement accounts such as 401(k) plans and individual retirement accounts (IRAs) are exempt. This includes distributions from pensions, annuities, profit-sharing, and stock bonus plans.

Tax-Exempt Interest: Interest payments from tax-exempt bonds or municipal securities are not subject to backup withholding.

Unemployment Compensation: Payments made as state or federal unemployment compensation are exempt from backup withholding.

State or Local Income Tax Refunds: These are generally not subject to backup withholding.

Certain Government and VA Benefits: Payments such as Social Security benefits, VA benefits, and similar government payments are typically exempt from backup withholding.

Certain Scholarships and Grants: Most scholarships and grant payments are exempt from backup withholding, especially those not presented as payment for teaching, research, or other services.

Alimony Payments: These personal payments are not subject to backup withholding.

Gambling Winnings Under Certain Conditions: Although gambling winnings can generally be subject to backup withholding, winnings from blackjack, baccarat, craps, roulette, and the big-6 wheel are not.

Cancelled Debts: Typically, cancelled debts are not subject to backup withholding, though they may need to be reported as income depending on the situation.

Criteria for Exemption

The exemption from backup withholding depends primarily on the nature of the payment and the payee’s reporting and compliance status. Here are the conditions under which payments are exempt:

Type of Payment: As listed above, certain types of payments are inherently exempt from backup withholding due to their nature. For example, most types of interest, dividends, and rent would typically be subject to withholding unless exempted by another criterion.

Exempt Status: Entities such as corporations, some trusts, and tax-exempt organizations typically do not face backup withholding on certain types of payment, like dividends and interest.

Accurate Reporting: Payments may be exempted from backup withholding if the payee’s taxpayer identification number has been accurately reported to the IRS, and there has been no history of underreported income as notified by the IRS.

IRS Notification: If the IRS explicitly notifies a payer that backup withholding is not required on certain payments due to the payee’s tax status or compliance history, those payments can be exempted accordingly.

Specific Legislation or Policy: Occasionally, specific IRS policies or federal legislation may exempt certain payments from backup withholding. These are typically aimed at minimizing administrative burden or encouraging certain economic activities.

Compliance and Reporting Requirements

For entities required to implement backup withholding on payments they distribute, understanding and adhering to the IRS’s compliance and reporting guidelines is essential. This section outlines the responsibilities of payers, including how to correctly report withheld taxes and handle errors such as over-withholding.

Responsibilities of Payers

Payers, such as employers, financial institutions, and businesses making reportable payments subject to backup withholding, must follow specific procedures:

Determining the Need for Backup Withholding: Before initiating any payments that might be subject to backup withholding, payers must first determine if the payee has provided a correct Taxpayer Identification Number (TIN) and if the IRS has notified them of any underreporting issues associated with the payee.

Applying the Correct Withholding Rate: As of the latest guidelines, the backup withholding rate is 24%. Payers must withhold this percentage from any payment subject to backup withholding, such as interest, dividends, or independent contractor payments.

Reporting Withheld Taxes: Payers must report the total amount of income and the corresponding amount withheld for each payee annually using Form 1099. The information from these forms helps payees report their income and withheld taxes correctly on their tax returns.

Depositing Withheld Taxes: The taxes that are withheld must be deposited with the IRS. This is generally done using the Electronic Federal Tax Payment System (EFTPS).

Filing Form 945: Annually, payers must file Form 945, “Annual Return of Withheld Federal Income Tax,” to report the total backup withholding they have collected during the year. This form does not include withholdings made on employee wages (which are reported separately on Form 941 or Form 944).

Issuing Notices to Payees: If backup withholding begins, payers are required to notify the payee within 15 days of the payment or by January 31 of the following year, whichever is earlier. This notice must explain that backup withholding has started, the reason for withholding, and the amount being withheld.

What to Do in Case of Errors

Errors in backup withholding, such as over-withholding or withholding when not warranted, can and do occur. Here’s how payers should handle these situations:

Refunding Over-Withheld Amounts: If a payer realizes that an excess amount has been withheld from a payee’s payment, they can refund the over-withheld amount to the payee before the end of the year. This correction must be reflected in the amounts reported on Form 945 and the payee’s Form 1099.

Adjusting Subsequent Deposits: If the over-withheld amount cannot be refunded directly to the payee (for instance, if the payee cannot be contacted or it is past the year-end), the payer can adjust the subsequent tax deposits to the IRS. This adjustment should reflect the over-withholding, and detailed records should be kept to justify the reduced deposit.

Correcting Reporting Errors: If incorrect information was reported on Form 1099, the payer should issue a corrected form. This involves filing a corrected Form 1099 and providing a copy to the payee. If the error pertains to the amount of tax withheld, corresponding adjustments must be made on Form 945.

Handling IRS Notifications: If the IRS contacts a payer about a discrepancy or an error in the amounts withheld or deposited, it is crucial for the payer to respond promptly and follow the instructions provided by the IRS to resolve the issue.

FAQ on Backup Withholding

This FAQ section addresses commonly asked questions regarding backup withholding that have not been covered in previous sections. It provides detailed answers to help both payers and payees understand some of the nuances and specific scenarios related to backup withholding.

1. What if I provided my TIN but the payer still initiated backup withholding?

If you have already provided a correct TIN and backup withholding was initiated, you should first verify with the payer that they have your correct and current TIN on file. If there is an error in the payer’s records, provide them with Form W-9 as proof of your correct TIN. If the payer’s records are correct but backup withholding persists, you may need to contact the IRS to ensure that no error on their part is causing the unwarranted withholding.

2. How can I stop backup withholding once it has started?

To stop backup withholding, you must first address the reason it was initiated:

- Provide the correct TIN to the payer and ensure it matches the IRS records.

- File any unfiled tax returns and pay any due taxes.

- Resolve any underreporting issues as notified by the IRS. Once these issues are resolved, inform the payer, who must then stop the withholding.

3. Are there specific forms I need to complete to report or stop backup withholding?

Yes, to report or update your TIN, use Form W-9, Request for Taxpayer Identification Number and Certification. To stop backup withholding, correct any relevant issues (like unfiled taxes or incorrect TINs) and provide evidence of these corrections to the payer. The payer may also require additional documentation based on their policies or IRS guidelines.

4. Can backup withholding be refunded by the IRS if it was done in error?

Backup withholding is credited against the taxes owed when you file your income tax return. If it was withheld in error and the payer cannot refund it directly to you by adjusting subsequent transactions within the same calendar year, you should report the withholding on your tax return. If the total withholding exceeds your tax liability, you will receive a refund from the IRS.

5. What happens if a payer fails to withhold when required?

If a payer fails to apply backup withholding where required, the IRS can hold the payer responsible for the amount that should have been withheld. This can include penalties and interest. Payers must ensure they comply with IRS regulations to avoid such liabilities.

6. How does backup withholding affect my estimated tax payments?

Backup withholding reduces the amount of estimated tax payments you need to make since it is treated as tax already paid throughout the year. If backup withholding covers or exceeds your expected tax liability, you might reduce or skip estimated tax payments. Always consult with a tax professional to understand how to adjust your estimated tax payments properly.

7. Is backup withholding the same as regular withholding on wages?

No, backup withholding is different from regular withholding on wages. Regular withholding relates to employment income and is based on the W-4 form’s information. Backup withholding applies to non-wage income such as interest, dividends, and freelance income when specific conditions trigger it.

8. What records should I keep regarding backup withholding?

Both payers and payees should keep detailed records of all transactions subject to backup withholding, including dates, amounts, types of income, and copies of any forms submitted or received (like Form 1099 and Form W-9). These records will be crucial for tax reporting, resolving discrepancies, and proving compliance in case of IRS inquiries.

9. Are foreign persons subject to backup withholding?

Foreign persons typically do not face backup withholding on U.S.-source income; instead, they are subject to NRA (Nonresident Alien) withholding, which involves different rates and conditions. However, certain payments to foreign persons that are effectively connected with a U.S. trade or business may be subject to backup withholding unless exempted under a tax treaty or other IRS regulations.

10. Can backup withholding apply to electronic payments like PayPal or Venmo?

Yes, electronic payments made through third-party networks such as PayPal or Venmo can be subject to backup withholding if they meet the thresholds for reporting on Form 1099-K. This usually includes payments for goods and services exceeding a specified limit.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

Trusted By

Trusted by 3.2M+ Employees: 21 Years of Service Across Startups to Fortune 500 Enterprises

Join our ever-growing community of satisfied customers today and experience the unparalleled benefits of TimeTrex.

Strength In Numbers

Join The Companies Already Benefiting From TimeTrex

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.