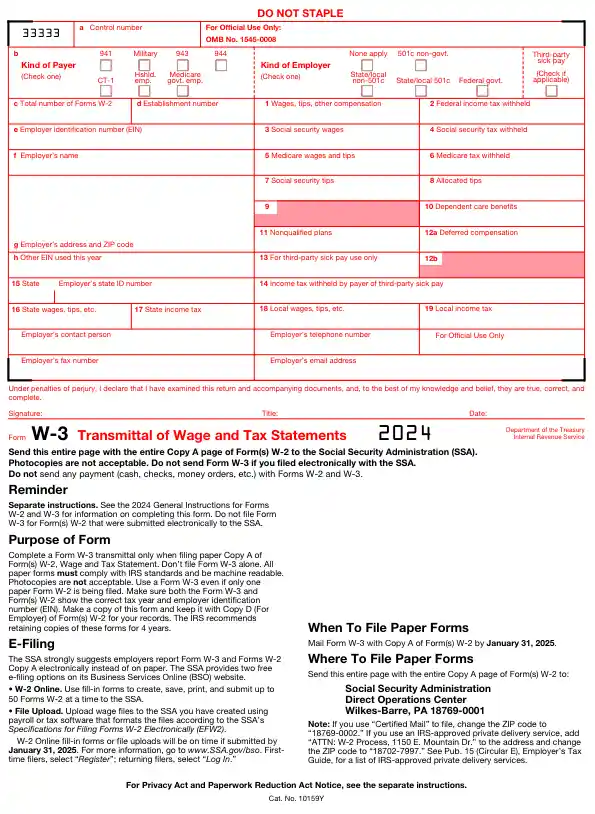

Glossary: W-3 Form

Image Retrieved From: https://www.irs.gov/pub/irs-pdf/fw3.pdf

What is a W-3 Form?

The W-3 Form, officially titled “Transmittal of Wage and Tax Statements,” is a document used by the Internal Revenue Service (IRS) to summarize and transmit copies of Forms W-2. Employers must submit this form to the Social Security Administration (SSA) as it serves as a cover sheet for all the W-2 forms sent by an employer for the year. It is essential in the process of reporting wages and deductions for employees but is not sent to employees like the W-2 form.

Purpose

The primary purpose of the W-3 Form is to report the total earnings, Social Security wages, Medicare wages, and withholding for all employees for a given tax year. This consolidated report helps the SSA to accurately record employees’ annual earnings, which are crucial for determining their Social Security benefits. The form must include aggregate information from all the W-2 forms an employer submits and is required whether the employer files paper forms or submits them electronically.

Who Must File the W-3 Form?

Employer Obligations

The W-3 Form must be filed by employers who are required to file Form W-2, Wage and Tax Statement. This includes all employers who pay remuneration for services performed by an employee, including non-cash payments of $600 or more for the year, or any amount if taxes were withheld. Here are specific obligations based on employer types:

- Private Sector and Corporate Employers: Any business or corporation that employs workers and withholds taxes must file Form W-2 for each employee and summarize those forms with a W-3.

- Governmental Organizations and Agencies: Local, state, and federal governmental entities must file these forms for their employees, mirroring the private sector’s requirements.

- Non-Profit Organizations: Non-profits, despite their tax-exempt status, are not exempt from filing W-2 forms for their employees and must also submit a W-3 form.

- Household Employers: Individuals who employ household personnel (like nannies or housekeepers) and pay wages subject to federal income tax withholding must file W-2 forms and a W-3 form.

- Farm Employers: Those who employ farm workers and pay wages that meet the filing requirements set by the IRS need to submit these forms.

- Self-Employed Individuals: While self-employed individuals do not typically file W-2s for themselves, they must file them for any employees they might have, along with the W-3.

It is important for new employers or those filing for the first time to obtain an Employer Identification Number (EIN) from the IRS before submitting W-2 and W-3 forms.

Submission Requirements

The due date for filing 2024 Forms W-2 and the accompanying W-3 with the Social Security Administration is January 31, 2025. This deadline applies regardless of whether the employer files using paper forms or electronically. Here are further details regarding the submission:

- Electronic Filing: Employers are encouraged to file electronically for faster processing and to reduce errors. The SSA provides tools and resources on their Business Services Online (BSO) platform to facilitate e-filing.

- Paper Filing: Paper filings must be sent to the correct address and organized properly to ensure they are processed without delays. Employers should use the official red-ink versions of the W-3 form when filing by mail.

- Extensions: There is no automatic extension for filing W-2 and W-3 forms. However, one 30-day extension to file can be requested using Form 8809, Application for Extension of Time To File Information Returns. This request must be justified by extraordinary circumstances or catastrophe and is not granted liberally.

Failure to meet the filing deadline or incorrectly filing can result in penalties, which increase depending on the length of the filing delay and the employer’s promptness in correcting errors. It is critical for employers to keep accurate payroll records and to prepare these forms in advance of the filing deadline to avoid penalties and to ensure their employees’ Social Security records are accurate.

| Box | Description | Instructions |

|---|---|---|

| a - Control number | Optional for numbering the whole transmittal | Use if you want to assign numbers to your forms for internal tracking |

| b - Kind of Payer | Check the box that applies to your type of employment | Only one box should be checked. Separate forms must be sent for different payer types |

| c - Total number of Forms W-2 | Number of W-2 forms being transmitted | Include all W-2 forms except those marked as "VOID" |

| d - Establishment number | Optional for identifying separate establishments | Can file separate W-3 for each establishment or one for all under the same EIN |

| e - Employer identification number (EIN) | 9-digit EIN assigned by the IRS | Must match the EIN used on your employment tax forms; do not use a prior owner's EIN |

| f - Employer's name | Name as shown on your tax forms | Enter the legal name of your business |

| g - Employer's address and ZIP code | Business mailing address | Include the complete address used on your tax forms |

| h - Other EIN used this year | Other EINs used for filing other tax forms this year | Enter any other EIN used if different from the one in box e |

| Ensure that all information matches the totals from related employment tax forms (e.g., Forms 941, 943, 944) and reconcile any differences. | ||

Data Retrieved From: https://www.irs.gov/instructions/iw2w3#en_US_2024_publink1000308389

| Box | Description | Instructions |

|---|---|---|

| 10 - Dependent care benefits | Total reported in box 10 on Forms W-2 | Enter the sum of dependent care benefits reported across all W-2 forms. |

| 11 - Nonqualified plans | Total reported in box 11 on Forms W-2 | Enter the sum of distributions from nonqualified plans as reported across all W-2 forms. |

| 12a - Deferred compensation | Total of all amounts reported with specific codes in box 12 on Forms W-2 | Sum the amounts reported with codes D through H, S, Y, AA, BB, and EE. Do not enter codes, only the total amount. |

| 14 - Income tax withheld by payer of third-party sick pay | Total income tax withheld by third-party payers on payments to all your employees | Complete this box only if applicable; include this tax in the box 2 total but also show it separately here. |

| 15 - State/Employer's state ID number | State or territorial ID number where the employer reports state income tax | Enter the two-letter state abbreviation and your state-assigned employer ID number. Use "X" if reporting for multiple states. |

| 16 through 19 | State/local wages, tips, etc., and income tax withheld | Report total state/local wages and income tax withheld as summed across all W-2 forms; enter totals in respective boxes. |

| Box 9 | Reserved | Do not enter any amount in box 9, as it is reserved for future use. |

| Box 13 | For third-party sick pay use only | Leave this box blank unless specifically used for third-party sick pay adjustments. |

| Note: Double-check that all totals match the corresponding totals on Forms W-2 and all related tax forms to avoid discrepancies that might lead to IRS inquiries. | ||

Data Retrieved From: https://www.irs.gov/instructions/iw2w3#en_US_2024_publink1000308389

Requirements for Filing W-3

Content Requirements

The W-3 form is a summary document that aggregates the information provided on all W-2 forms submitted by an employer. To ensure accurate processing, the W-3 must include specific information:

- Employer Identification Number (EIN): This unique number assigned by the IRS identifies the employer submitting the W-2 forms.

- Employer’s Name and Address: The legal name of the business and its mailing address, including ZIP code.

- Total Number of W-2 Forms: The form requires the total count of all W-2 forms being transmitted with the W-3.

- Total Amounts for Each Income and Tax Category:

- Total wages, tips, and other compensation.

- Total federal income tax withheld.

- Total Social Security wages.

- Total Social Security tax withheld.

- Total Medicare wages and tips.

- Total Medicare tax withheld.

- Total Advanced Earned Income Credit (EIC) payments (if applicable).

- Establishment Number: If applicable, a code that identifies different components or branches of a large organization.

- Contact Person, Telephone Number, and Email Address: Information for the individual who can be contacted for any queries related to the form.

- Fax Number: If available, to provide an alternative contact method.

- Kind of Payer: Information about the type of employer (e.g., non-profit, governmental, etc.) and the tax forms applicable.

This comprehensive data ensures that the IRS and SSA can correctly match the submitted W-2 forms to the employer’s summary report, verify the totals, and update employees’ records accurately.

Methods of Submission

Employers have two main options for submitting the W-3 form along with the associated W-2 forms: electronic filing (e-filing) and paper filing. Each method has specific requirements and benefits:

Electronic Filing (e-filing):

- Mandatory for Large Employers: Employers filing 250 or more W-2 forms must e-file the W-2 and W-3 forms. This threshold is subject to change, and the IRS encourages e-filing regardless of the number of W-2 forms due to its efficiency and reduced error rates.

- BSO Platform: The Social Security Administration’s Business Services Online (BSO) allows employers to submit these forms electronically. The BSO also provides tools to create, save, and submit forms directly to the SSA.

- Advantages: Faster processing, immediate confirmation receipts, reduced risk of errors, and a more environmentally friendly option compared to paper forms.

- Security: E-filing via BSO is secure, requiring registration and authentication to protect sensitive information.

Paper Filing:

- Red-ink Forms: Employers choosing to file by paper must use the official red-ink form for W-3, which is scannable and necessary for SSA processing equipment.

- Mailing Address: Paper forms should be sent to the SSA’s designated mailing address, which is specifically for W-2 and W-3 submissions.

- Limitations: Slower processing times, higher risk of errors, and potential for loss or delays in the mail.

- Recommendation for Small Batch Filers: While small employers (those filing fewer than 250 W-2 forms) are not required to e-file, it is recommended to consider electronic options for their benefits.

Recent Changes and What’s New for 2024

Legislative Updates

The 2024 tax year brings significant regulatory changes impacting the filing of Form W-3 and associated W-2 forms, primarily driven by ongoing efforts to streamline tax administration and enhance tax compliance through digital means.

Mandatory Electronic Filing Threshold: The most notable legislative change is the adjustment of the electronic filing (e-filing) threshold. Previously, employers were required to e-file if they were submitting 250 or more W-2 forms. As of the 2024 tax year, this threshold has been significantly lowered. Now, employers filing 10 or more W-2 forms are required to submit these forms electronically to the Social Security Administration (SSA). This change is part of a broader initiative under the Taxpayer First Act of 2019 to increase electronic filing participation, thereby reducing processing times and improving accuracy in tax record maintenance.

Penalty Adjustments for Non-compliance: Another legislative change is the increase in penalties for late filing or failure to comply with the e-filing requirements. These adjustments are intended to reinforce compliance and ensure timely and accurate submissions. The penalty structure has been indexed to inflation, which may increase the financial implications for non-compliance year over year.

Form Revisions

Alongside legislative changes, there have been updates to the layout and content requirements of the Form W-3 to accommodate new reporting needs and to clarify previous ambiguities:

Revised Layout for Clarity: The 2024 version of Form W-3 has been redesigned to enhance readability and ease of use. Changes include clearer labeling of fields, better alignment of the form layout with the electronic versions, and simplified instructions directly embedded within the form to assist employers in completing it correctly.

Updated Requirement for Reporting Qualified Sick Leave Wages and Family Leave Wages: In response to previous emergency relief measures (such as those introduced under the Families First Coronavirus Response Act), there are now designated fields for reporting qualified sick and family leave wages reimbursed under specific COVID-19 tax credits, should similar credits be reintroduced or remain applicable.

Clarification on Deferral Reporting: There has been a clarification on the reporting of deferred amounts under various payroll tax deferral provisions. This includes specifying how these deferrals should be reported to ensure they are not mistaken for current year liabilities.

Electronic Filing (e-filing) of W-3

E-filing Requirements

Electronic filing (e-filing) of the W-3 form along with W-2 forms has become increasingly emphasized by the IRS and SSA due to its efficiency and accuracy benefits. The 2024 tax year introduces stricter e-filing requirements:

- Who is Required to File Electronically: Starting in 2024, any employer who needs to file 10 or more W-2 forms must submit them electronically. This new threshold is a significant reduction from the previous requirement of 250 forms, reflecting a push towards digital submissions.

- Benefits of E-filing:

- Accuracy: Reduced risk of errors due to data validation features in e-filing systems.

- Speed: Faster processing of returns and quicker confirmation of receipt by the SSA.

- Security: Enhanced security measures to protect sensitive information.

- Convenience: Ability to file from the office or home without the need to mail physical forms.

- Environmental Impact: Decreases the use of paper, benefiting environmental sustainability.

- Cost Savings: Reduces costs associated with printing and mailing.

How to E-file: Using the SSA's Business Services Online (BSO) Portal

Filing your W-2 and W-3 forms electronically is streamlined through the use of the SSA’s Business Services Online (BSO) portal. Here’s a step-by-step guide to using this resource:

Registration:

- Step 1: Visit the SSA’s BSO website and register for an account. You will need to provide your business details, including your EIN, and create a username and password.

- Step 2: Once registered, you will receive a letter in the mail from the SSA with a unique activation code. You will need to log in to BSO and enter this code to activate your BSO account.

Accessing the Filing Services:

- Step 3: Log in to your BSO account. Select the ‘Business Services Online’ page and then choose the ‘W-2/W-3 Online’ option to create and submit your Forms W-2 and W-3.

Creating Forms:

- Step 4: Use the ‘Create/Edit/Submit W-2 Report’ service. You can enter data manually for each W-2 form or upload a batch file if you have multiple forms. BSO provides a template and file specifications for creating batch files correctly.

- Step 5: After entering or uploading all W-2 data, the system will automatically generate the W-3 form based on the aggregate data from the W-2 forms.

Review and Edit:

- Step 6: Review all entered information for accuracy. You can make edits directly in the portal if any details are incorrect or incomplete.

Submission:

- Step 7: Once all forms are accurate, proceed to submit them. BSO will validate your entries and alert you to any errors that must be corrected before final submission.

- Step 8: After successful validation, submit the forms. BSO will provide a confirmation receipt that you should keep for your records.

Record Keeping:

- Step 9: Download or print a copy of the submitted W-2 and W-3 forms from BSO for your records. It is recommended to keep these forms for at least four years in case of audits or inquiries from the IRS or SSA.

Additional Tips

- Filing Deadline: Remember that all W-2 and W-3 forms must be submitted by January 31st of the year following the tax year in question. For tax year 2024, the deadline is January 31, 2025.

- Technical Support: If you encounter technical issues or have questions about using BSO, you can contact the SSA’s employer reporting services for assistance.

Common Errors and Penalties

Typical Mistakes

Filing the W-3 form along with W-2 forms can be prone to errors if not done carefully. Common mistakes include:

- Incorrect Employer Information: Errors in entering the employer’s EIN, name, or address. It’s crucial that this information matches what the IRS has on file to avoid processing delays.

- Mismatched Totals: The totals on the W-3 form must exactly match the sum of the corresponding totals from all W-2 forms it summarizes. Discrepancies here are a common source of errors.

- Incorrect or Missing Social Security Numbers (SSNs): SSNs must be accurately reported and correspond to the correct employee.

- Data Entry Errors: Incorrect wage, tax withheld, or other numerical data can lead to significant issues with employee tax records.

- Filing Incorrect Form Versions: Using outdated or incorrect forms that do not meet current year requirements.

- Failure to File Electronically: Not adhering to the electronic filing requirements when mandated, depending on the number of W-2 forms to be filed.

Penalties

The IRS imposes penalties for late, incorrect, or incomplete filings, which can be substantial depending on the nature and extent of the error:

- Late Filing: If Forms W-2 and W-3 are not filed by the due date (January 31), the penalty ranges from $50 to $280 per form, depending on how late the forms are filed, with a maximum of $1,130,500 per year for small businesses.

- Failure to File Electronically: Employers required to e-file but who fail to do so may be penalized $280 per form, with the same maximum penalty as late filing.

- Incorrect Information: If incorrect information is provided on the W-3 or W-2 forms, penalties start at $50 per form with similar maximums, depending on the duration until correction and the overall volume of errors.

- Intentional Disregard: If the failure to correctly file is found to be intentional, the penalty jumps to at least $570 per W-2 form with no maximum cap, reflecting the severity of such violations.

How to Avoid Penalties

To minimize the risk of incurring penalties, consider the following best practices:

- Preparation: Start the W-2 and W-3 preparation process early to ensure enough time for review and corrections before the filing deadline.

- Accuracy: Double-check all entries for accuracy, especially SSNs, EINs, and total calculations. Use software that automatically checks for common errors.

- Electronic Filing: Embrace electronic filing methods, which typically include built-in checks that can catch common mistakes before submission.

- Stay Informed: Keep up to date with IRS updates and changes to filing requirements, especially those related to thresholds for electronic filing and form revisions.

- Seek Professional Help: If unsure about the filing process or if your business has complex filing needs, consult with a tax professional or payroll specialist.

- Record Keeping: Maintain thorough records of all filings and supporting documents, which can be invaluable if you need to contest a penalty or provide proof of compliance.

Helpful Resources and Links

Navigating the complexities of W-2 and W-3 form submissions can be challenging. Below is a compilation of resources and contact information that can assist employers in obtaining necessary forms, understanding filing requirements, and seeking additional help if needed.

Downloadable Forms

To access and download the latest W-2 and W-3 forms, as well as their instructions, employers can visit the following official websites:

Internal Revenue Service (IRS)

- W-2 Form Download W-2 Form

- W-3 Form Download W-3 Form

- Instructions and other relevant tax publications can be found at IRS Forms and Publications.

Social Security Administration (SSA)

- Business Services Online (BSO) portal for electronic filings: SSA BSO

- W-2/W-3 Online Filing Instructions SSA Employer W-2 Filing Instructions

These forms are updated each tax year to reflect current regulations and requirements, so it is important to use the latest versions to avoid compliance issues.

Contact Information

For direct assistance with W-2 and W-3 forms or any related issues, employers can reach out to the following contacts:

Internal Revenue Service (IRS)

- Tax Help Line for Businesses: 800-829-4933 – For general business tax questions including filing and administration of W-2 and W-3 forms.

- Taxpayer Assistance Centers: Find Locations – Offers in-person tax help by appointment.

Social Security Administration (SSA)

- Employer Reporting Service Center: 800-772-6270 – For queries related to W-2 and W-3 submissions via the Business Services Online (BSO) portal.

- Technical Support: 888-772-2970 – For technical issues with the online filing system.

- Business Services Online (BSO) Help Desk: Provides support for users navigating the BSO website and filing forms electronically.

Additionally, employers can find regional SSA office contacts through the SSA Office Locator, which provides local support for payroll and tax filing questions.

Additional Online Resources

To further aid in understanding and complying with the requirements for W-2 and W-3 filings, consider exploring the following online resources:

- IRS Electronic Federal Tax Payment System (EFTPS): EFTPS – An online system for paying federal taxes electronically, including payroll taxes associated with W-2 and W-3 filings.

- IRS Video Portal: IRS Videos – Contains video guides and webinars that can help employers understand various tax responsibilities including how to properly file W-2 and W-3 forms.

- SSA Business Services Online (BSO) Tutorial: BSO Tutorials – A step-by-step guide to registering and using the BSO portal effectively.

Frequently Asked Questions (FAQs) about W-2 and W-3 Forms

What if I discover an error after submitting my W-2 and W-3 forms?

If you find an error after submitting your W-2 and W-3 forms to the Social Security Administration (SSA), you must file a corrected W-2 form, known as W-2c, and a corresponding W-3c form to summarize the corrected W-2 forms. These corrections can address anything from incorrect employee SSNs, wages, or tax amounts to misreported benefit contributions.

Can I file W-2 and W-3 forms for previous years electronically?

Yes, you can file W-2 and W-3 forms for previous years electronically using the SSA’s Business Services Online (BSO). This platform allows the submission of both current and prior year documents. It is important to ensure that you use the forms specific to the tax year you are correcting or filing for.

Are there different types of W-3 forms for different types of payers?

Yes, there are different versions of the W-3 form depending on the type of employer and the location of the employees. For example, there is a specific W-3SS form used by employers in U.S. territories such as Guam, American Samoa, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. Ensure you use the correct form corresponding to the type of W-2 forms you are submitting.

How can I verify the accuracy of employee SSNs before filing?

The SSA offers a free service called the Social Security Number Verification Service (SSNVS) which employers can use to verify employee SSNs against SSA records. This is a crucial step to avoid filing errors and potential penalties for incorrect information.

What are the consequences of not filing W-2 and W-3 forms on time?

Failing to file W-2 and W-3 forms on time can lead to penalties that range from $50 to $280 per form, depending on how late the forms are filed, with a maximum penalty that can reach over a million dollars for large businesses. These penalties apply to each W-2 form not filed on time, which can accumulate significantly for large employers.

How long should I keep filed W-2 and W-3 forms?

The IRS and SSA recommend that employers keep copies of filed W-2 and W-3 forms for at least four years after the filing date or the date on which taxes were due, whichever is later. This documentation is crucial for future reference in case of audits or employee inquiries about past income and tax withholdings.

What if I am a new employer and don't have an EIN yet?

New employers must obtain an Employer Identification Number (EIN) from the IRS before they can start filing W-2 and W-3 forms. You can apply for an EIN online, by fax, or by mail through the IRS. Once you receive your EIN, you can register for BSO and begin filing electronically.

Can I truncate employee SSNs on W-2 forms?

Yes, employers are allowed to truncate employee SSNs on copies of W-2 forms distributed to employees (turning the SSN into a format like XXX-XX-1234), but you must provide the full SSN on the copies sent to the SSA and IRS. This helps protect employee identity while maintaining record accuracy for tax purposes.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

Trusted By

Trusted by 3.2M+ Employees: 21 Years of Service Across Startups to Fortune 500 Enterprises

Join our ever-growing community of satisfied customers today and experience the unparalleled benefits of TimeTrex.

Strength In Numbers

Join The Companies Already Benefiting From TimeTrex

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.