Explaining a W-2 Employee

What Is a W-2 Employee?

A W-2 employee holds a specific employment status in the United States, characterized by a formal relationship with their employer. This designation is more than just a title; it’s a classification that affects taxation, benefits, and legal protections. Understanding the nuances of being a W-2 employee is crucial for navigating the workforce in the U.S., whether you’re entering your first job or transitioning from freelance or contract work.

The Basics of W-2 Employment

At its core, a W-2 employee is someone who works for an organization or company and receives a W-2 form each year. This form, known as the Wage and Tax Statement, reports the amount of money earned and the taxes withheld by the employer. This distinction is vital for tax purposes, as it directly impacts how an individual’s income is reported to the Internal Revenue Service (IRS).

Key Differences from Contractors and Freelancers

Unlike independent contractors or freelancers—who often use a 1099 form to report their earnings and pay their own taxes—W-2 employees have taxes withheld from their paychecks. This withholding covers federal income tax, Social Security, and Medicare taxes, significantly simplifying the tax filing process for the employee.

Entitlement to Benefits and Protections

The classification of an individual as a W-2 employee brings with it a host of benefits and protections not typically afforded to contractors or freelancers. These include:

- Health Insurance: Employers often provide access to comprehensive health insurance plans, sometimes covering a portion of the premiums, which can represent a significant financial benefit.

- Paid Time Off (PTO): W-2 employees are frequently eligible for paid time off, including vacation days, sick leave, and personal time, allowing for work-life balance.

- Unemployment Insurance: This insurance offers financial support in the event of job loss under qualifying conditions, providing a safety net during periods of unemployment.

- Workers’ Compensation: In case of a work-related injury or illness, workers’ compensation insurance provides medical benefits and wage replacement, ensuring protection for employees.

Tax Implications and Withholdings

The method of taxation for W-2 employees is straightforward, with employers responsible for withholding the correct amount of taxes from each paycheck. This system alleviates the burden on employees to calculate and remit their taxes, unlike the self-employment tax responsibilities faced by freelancers and contractors.

Impact on Employment Rights

Being a W-2 employee also means enjoying certain employment rights and protections under U.S. law, such as:

- Minimum Wage Protections: Employees are guaranteed to receive at least the federal minimum wage for their work.

- Overtime Pay: Eligible employees earn overtime pay at a rate of 1.5 times their regular rate for hours worked beyond the standard 40-hour workweek.

- Family and Medical Leave Act (FMLA): Qualifying employees are entitled to unpaid, job-protected leave for specified family and medical reasons, with continuation of group health insurance coverage.

Understanding the W-2 Tax Form

The Form W-2, officially known as the Wage and Tax Statement, is a cornerstone document in the United States tax system, serving as a bridge between employers, employees, and the Internal Revenue Service (IRS). This form plays a pivotal role in the annual tax filing process, ensuring that the amount of money an employee earns and the taxes withheld from those earnings are accurately reported to the federal government.

Purpose and Importance of Form W-2

The primary purpose of the W-2 form is to report an employee’s annual wages and the amount of taxes withheld from their paycheck for the tax year. This includes federal income tax, Social Security tax, and Medicare tax. The information on the W-2 form is used by employees to prepare their annual tax returns, making it an indispensable tool for accurate and compliant tax filing.

Distinction from Independent Contractor Reporting

A critical distinction in tax reporting is between W-2 employees and independent contractors. While W-2 forms are used exclusively for employees, independent contractors receive a Form 1099-NEC (Nonemployee Compensation) to report their earnings. This differentiation underscores the tax responsibilities that employers have towards their employees, including tax withholding, versus the self-reporting tax obligations of independent contractors.

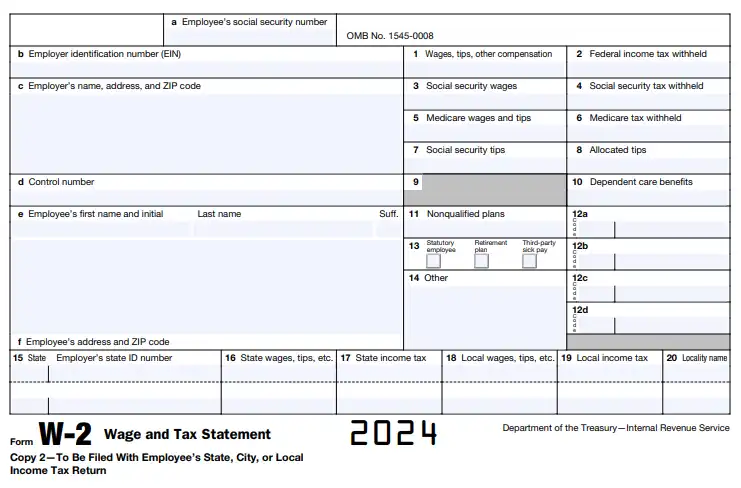

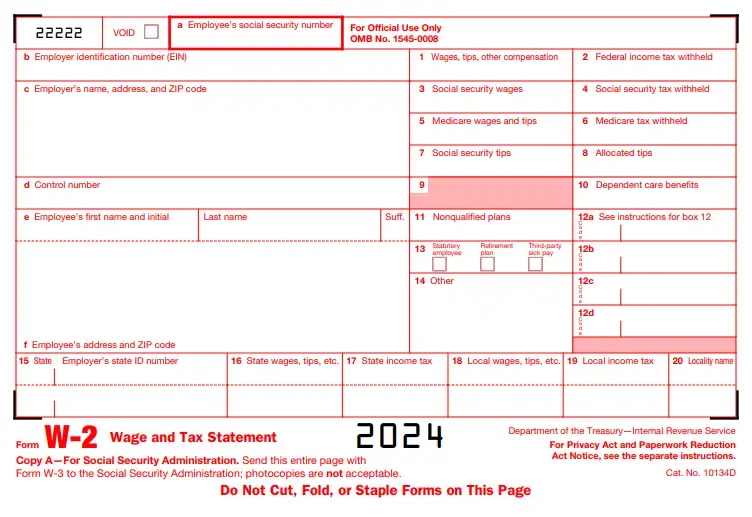

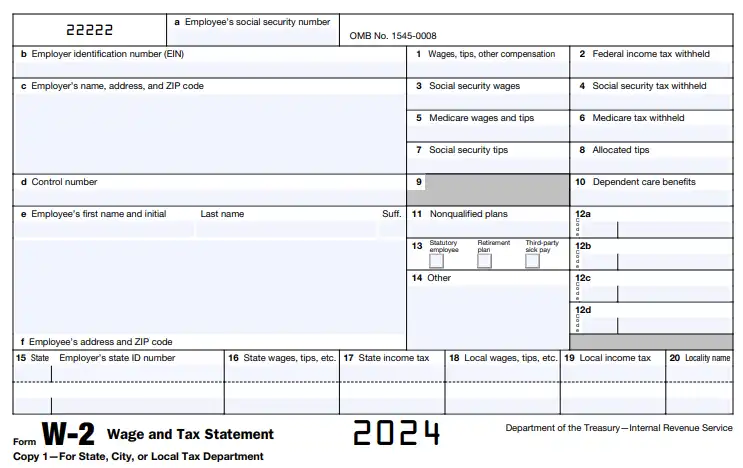

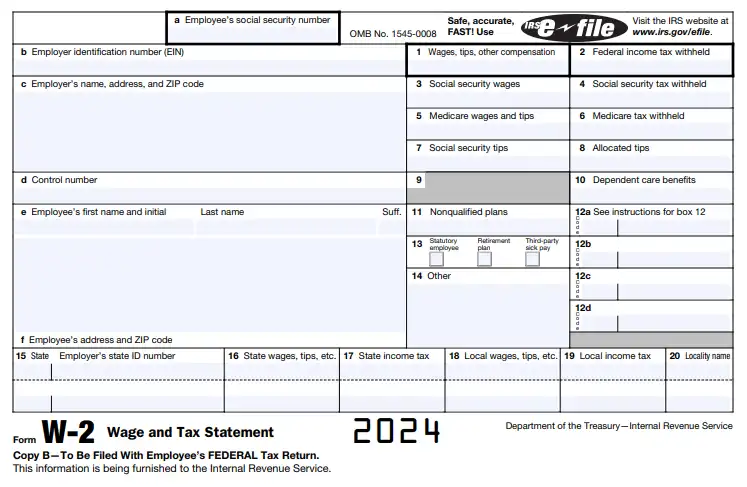

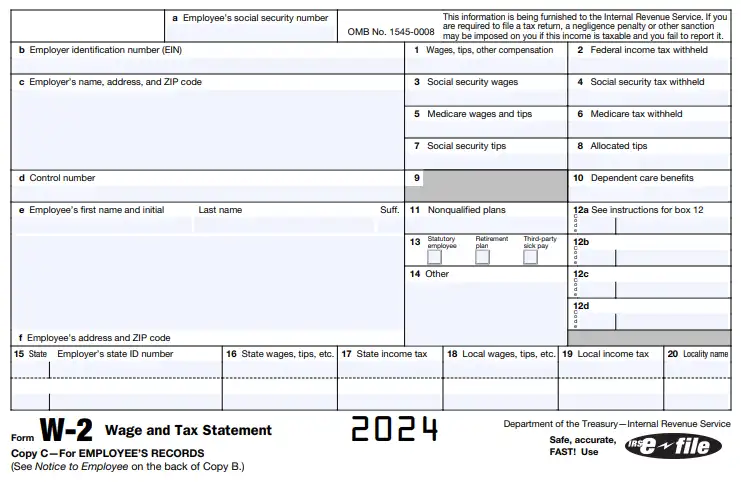

Components of the W-2 Form

The W-2 form is comprehensive, containing several important pieces of information, each designated by a specific box on the form:

- Wages and Salaries: This includes the total amount of taxable wages, tips, and other compensation.

- Federal Income Tax Withheld: The total amount of federal income tax withheld from the employee’s earnings.

- Social Security Wages: The wages subject to Social Security taxes, along with the amount withheld for Social Security taxes.

- Medicare Wages and Tips: Similar to Social Security, this reports the total wages subject to Medicare taxes and the amount withheld.

- State and Local Taxes: If applicable, these sections detail the amount of wages subject to state and local taxes and the amounts withheld.

Employer Responsibilities

Employers bear the responsibility of accurately completing and issuing W-2 forms to their employees by January 31st of the year following the tax year being reported. This ensures that employees have sufficient time to file their tax returns by the April deadline. Employers must also submit copies of the W-2 forms to the Social Security Administration (SSA), along with a W-3 form, which summarizes the W-2 information for all employees.

Employee Use of the W-2 Form

Upon receiving their W-2, employees use the information to fill out their IRS Form 1040 (U.S. Individual Income Tax Return) or other tax forms as required. The W-2 form provides the necessary data to determine the taxpayer’s total taxable income, calculate any refunds or taxes owed, and understand contributions to Social Security and Medicare.

Benefits of Being a W-2 Employee

The status of being a W-2 employee brings with it a spectrum of benefits, anchored not only in the legal framework but also in the varied compensation packages employers offer to attract and retain talent. These benefits extend beyond the paycheck, providing financial security, health benefits, and protections that are significant to the employee’s overall well-being and job satisfaction. Here’s a closer look at some of the key benefits associated with W-2 employment:

FICA Taxes: Social Security and Medicare Contributions

One of the foundational benefits for W-2 employees is the contribution to the Federal Insurance Contributions Act (FICA) taxes, which includes both Social Security and Medicare. These contributions are split between the employer and the employee, ensuring that employees are investing in their future eligibility for Social Security retirement benefits and Medicare health insurance. This shared responsibility eases the individual tax burden and secures a foundation for retirement and healthcare.

Worker’s Compensation: Protection Against Work-Related Injuries

Worker’s compensation is a mandatory benefit provided to W-2 employees, offering coverage for medical expenses and lost wages in the event of work-related injuries or illnesses. This insurance ensures that employees are protected financially during recovery periods, without having to bear the cost of medical treatments or worry about income during time off from work due to injury.

Unemployment Insurance: Financial Assistance During Unemployment

Unemployment insurance offers a temporary financial safety net for employees who lose their jobs without fault on their part, such as layoffs due to economic downturns. This benefit provides crucial financial support while the individual searches for new employment, helping to mitigate the stress and financial strain of job loss.

Health Insurance: Access to Comprehensive Care

Many employers offer health insurance as a key component of their benefits package, often covering a significant portion of the premiums. This benefit can include access to private health insurance plans, which may offer more comprehensive coverage options than those available through individual marketplaces. For employees, this translates into better access to healthcare services, preventive care, and potentially lower out-of-pocket healthcare costs.

FMLA Protections: Job Security During Extended Leave

The Family and Medical Leave Act (FMLA) allows eligible W-2 employees to take up to 12 weeks of unpaid leave for certain family and medical reasons, with a guarantee of job protection. This means employees can take necessary time off for serious health conditions, childbirth, or to care for ailing family members without fear of losing their employment.

Disability Insurance and Retirement Plans: Ensuring Long-Term Security

Disability insurance provides income protection for employees who are unable to work due to a disability, offering a portion of their income during the period of disability. Retirement plans, such as 401(k) plans, are another pivotal benefit, enabling employees to save and invest for their retirement with potential employer matching contributions, thereby enhancing their long-term financial security.

How to Obtain Your W-2 Form

Receiving your W-2 form promptly is crucial for timely and accurate tax filing. Employers are mandated by law to dispatch W-2 forms to their employees by January 31st of each year, ensuring that individuals have adequate time to prepare their tax returns before the April deadline. This form, which outlines your annual earnings and the taxes withheld, is indispensable for completing your tax filings.

Steps to Take if Your W-2 Hasn’t Arrived

Contact Your Employer: The first step should always be to reach out to your employer or the payroll department. There could be a simple explanation for the delay, such as an outdated address or an oversight.

Reach Out to the IRS: If you have not received your W-2 by February 14th, and your employer is unresponsive or unable to provide a satisfactory resolution, you can contact the IRS for assistance at 1-800-829-1040. You will need to provide your name, address, Social Security number, and an estimate of your wages and federal income tax withheld (based on your final pay stub of the tax year).

File Your Taxes: Even without a W-2, you are still required to file your taxes or request an extension by the deadline. You may use Form 4852, Substitute for Form W-2, Wage and Tax Statement, if necessary, to estimate your income and withholding.

Dealing with Multiple W-2 Forms

Changing jobs within a tax year can result in receiving multiple W-2 forms, each documenting the earnings and taxes withheld by your respective employers. This scenario is quite common and easily managed within your tax return by simply including the information from each W-2 form provided.

When You Receive Multiple W-2s from the Same Employer

Occasionally, you might receive more than one W-2 form from the same employer within a tax year. This situation usually requires verification to ensure there are no errors, except in specific circumstances such as:

- Employer EIN Change: If the employer underwent a change in ownership or reorganization and received a new Employer Identification Number (EIN) during the tax year.

- Corrected W-2s: Sometimes, an employer may issue a corrected W-2 (W-2C) if there were errors in the original document.

In such cases, ensure that you accurately report the information from each W-2 form on your tax return, as they collectively represent the total income and taxes withheld by your employer.

W-2 Equivalent for Non-US Employees

For foreign nationals employed by U.S. companies, the process of reporting income differs slightly. Instead of the W-2 form, international workers might receive Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding. This form is used for reporting:

- Income Paid to Non-resident Aliens: Regardless of whether the work was performed inside or outside the U.S.

- Tax Withheld: Amount of federal income tax withheld according to the tax treaties between the U.S. and the employee’s home country.

W-2 Forms From Multiple States

Receiving W-2 forms from multiple states can occur if you’ve worked in more than one state during the tax year, a common scenario for individuals who have changed jobs, worked in bordering states, or have been employed by companies with operations in multiple locations. This situation necessitates a more detailed approach to tax filing, as each state has its own tax laws and requirements. When filing your state tax returns, you’ll need to report the income earned in each respective state according to the information provided on each W-2 form. This may mean filing multiple state tax returns, in addition to your federal return, to accurately account for the taxes withheld and income earned in each state. It’s important to pay attention to the specific rules and reciprocal agreements between states, as some have arrangements that can simplify tax filing for residents who work across state lines. Properly managing W-2 forms from multiple states is crucial to ensuring compliance with all tax obligations and maximizing your potential tax benefits.

FAQs for W-2 Forms

What is a W-2 form?

The W-2 form, also known as the Wage and Tax Statement, is a document that employers must send to each of their employees and the IRS at the end of the tax year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck.

When should I receive my W-2 form?

Employers are required to provide you with your W-2 form by January 31st each year for the previous tax year’s earnings.

What should I do if I haven't received my W-2?

If you haven’t received your W-2 by February 14th, contact your employer to ensure they have your correct address. If you still do not receive your W-2, contact the IRS for assistance.

Can I file my taxes without a W-2?

If you haven’t received your W-2 in time for tax filing, you can use Form 4852, Substitute for Form W-2, to estimate your wages and taxes withheld. It’s important to attempt to obtain your W-2 from your employer first and to use accurate information to complete your tax return.

What if I receive my W-2 after filing taxes with Form 4852?

If you receive your W-2 after filing your taxes with a substitute form and notice differences in the amounts, you may need to amend your tax return using Form 1040-X.

How do I report multiple W-2 forms from different employers?

If you’ve worked for multiple employers in a tax year and received multiple W-2 forms, you need to report the information from each W-2 when you file your tax return. Combine the wages and taxes withheld from all forms to enter on your tax return.

What if I get two W-2 forms from the same employer?

Receiving two W-2 forms from the same employer may indicate a correction or an error, or it could occur if the company changed its Employer Identification Number (EIN) during the tax year. Verify with your employer why you received two forms and how to report them correctly on your tax return.

What are the key components of a W-2 form?

Key components include your Social Security Number, employer’s EIN, total wages earned, federal and state taxes withheld, Social Security and Medicare earnings and taxes withheld, and any additional compensation like tips.

What should I do if I find an error on my W-2?

If you discover an error on your W-2, contact your employer as soon as possible to issue a corrected W-2 form (W-2C).

Are there electronic versions of W-2 forms?

Yes, many employers offer electronic W-2 forms through secure online portals. You can choose to receive your W-2 electronically, often accessing it sooner than waiting for a paper copy. Ensure your employer has your correct email address and consent to receive it electronically.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

Trusted By

Trusted by 3.2M+ Employees: 21 Years of Service Across Startups to Fortune 500 Enterprises

Join our ever-growing community of satisfied customers today and experience the unparalleled benefits of TimeTrex.

Strength In Numbers

Join The Companies Already Benefiting From TimeTrex

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.