Adjusted Gross Income (AGI): A Comprehensive Guide

Flowchart for Calculating AGI

(All income forms and sources)

- Self-employment tax

- Educator expenses

- Student loan interest

- IRA contributions

- Health premiums

- Other eligible deductions

What is Adjusted Gross Income (AGI)?

Definition of AGI

Adjusted Gross Income (AGI) is a measure used by the U.S. Internal Revenue Service (IRS) to determine the amount of income that is taxable. AGI is calculated from your gross total income, which includes all earnings from various sources such as wages, dividends, alimony, capital gains, business income, and retirement distributions. From this gross income, certain deductions or “adjustments” are subtracted. These adjustments may include educator expenses, student loan interest, contributions to retirement accounts, and others specifically allowed by the IRS.

Explanation of Why AGI is a Crucial Metric in the U.S. Tax System

AGI is fundamental to the U.S. tax system for several reasons:

Basis for Tax Calculations: AGI is the starting point for calculating your tax liability. It influences the tax brackets into which you fall and determines your rate of taxation.

Eligibility for Deductions and Credits: Many tax deductions and credits are only available if your AGI falls below certain thresholds. For instance, eligibility for the Earned Income Tax Credit (EITC) and deductions for educational expenses or medical expenses are affected by your AGI.

Impact on Social Benefits: AGI is also used to determine eligibility for several government-sponsored social programs. A lower AGI can qualify individuals for more benefits such as healthcare subsidies under the Affordable Care Act.

Financial Planning: Understanding your AGI can help in financial planning, especially in foreseeing tax liabilities and potential refunds. This helps taxpayers manage their finances better, planning for investments, and making informed decisions about retirement contributions.

State Tax Calculations: Many states also use your federal AGI as a starting point for their tax calculations, making it a critical figure in multiple jurisdictions.

Key Formula: AGI = Gross Income – Adjustments to Income

The formula to calculate AGI is straightforward:

Adjusted Gross Income (AGI) = Total Gross Income − Adjustments to Income

Total Gross Income includes all income before any deductions are applied. This encompasses:

- Wages and salaries reported on W-2 forms.

- Income from self-employment.

- Earnings from dividends, interest, and rents.

- Profits realized from the sale of assets like stocks or real estate.

- Pensions, annuities, and other retirement benefits.

Adjustments to Income might include:

- Educator expenses if you are a teacher purchasing classroom supplies.

- Health savings account (HSA) contributions.

- Deductions for IRA contributions and certain other retirement plans.

- Tuition and fees deduction for education expenses.

- Student loan interest deduction.

Components of Gross Income

Gross income is an all-encompassing term used by the IRS to describe the total income earned by an individual from all sources before any deductions or adjustments are applied. Understanding the components of gross income is crucial for accurately calculating Adjusted Gross Income (AGI). Here’s a detailed look at what constitutes gross income:

Wages and Salaries

- Definition: Income received from employment, including wages, salaries, bonuses, commissions, and tips.

- Common Sources: Employer payments, performance bonuses, sales commissions, and gratuities received while employed.

- Tax Forms Involved: Typically reported on Form W-2 provided by employers.

Dividends and Interest Earnings

- Definition: Income generated from investments.

- Dividends: Payments made to shareholders out of a corporation’s profits.

- Interest Earnings: Money earned from deposit accounts like savings accounts, or from investments in bonds.

- Common Sources: Stock dividends, payments from mutual funds, interest from bank accounts or bonds.

- Tax Forms Involved: Generally reported on Forms 1099-DIV for dividends and 1099-INT for interest earnings.

Capital Gains

- Definition: Profits from the sale of assets such as stocks, bonds, and real estate.

- Types:

- Short-term Capital Gains: Profits from assets held for one year or less, taxed as ordinary income.

- Long-term Capital Gains: Profits from assets held for more than one year, typically taxed at a lower rate.

- Common Sources: Sale of stocks, real estate transactions, and other investments.

- Tax Forms Involved: Reported on Schedule D and Form 8949 attached to the personal tax return.

Business Income (Self-employed and Small Business Income)

- Definition: Earnings from conducting a trade or business as a sole proprietor, independent contractor, or from owning a part of a partnership or S corporation.

- Common Sources: Business operations, freelance services, consulting fees.

- Tax Forms Involved: Generally reported on Schedule C for sole proprietors or appropriate forms for partnerships and S corporations.

Retirement Distributions

- Definition: Withdrawals from retirement accounts such as IRAs, 401(k)s, pensions, and annuities.

- Common Sources: Pension payments, 401(k) distributions, IRA withdrawals.

- Tax Considerations: Often taxable depending on the type of account and the nature of the distribution; some distributions may be partially or entirely tax-free if specific conditions are met.

- Tax Forms Involved: Typically reported on Form 1099-R.

Other Miscellaneous Income Sources

- Rental Income: Money received for the use of property.

- Royalties: Payments for the use of intellectual property or natural resources.

- Alimony: Payments received from a former spouse if the divorce agreement was finalized before 2019.

- Gambling Winnings: Income from lotteries, casinos, sports betting, and other gambling activities.

- Unemployment Compensation: Money received from the government or private entities during unemployment.

- Social Security Benefits: Monthly retirement or disability payments from Social Security, which may be taxable depending on overall income levels.

- Tax Forms Involved: Varies by income type but often includes 1099-MISC for miscellaneous income, 1099-G for unemployment compensation, and SSA-1099 for Social Security benefits.

Adjusted Gross Income (AGI) Income Adjustments

| Category | Description |

|---|---|

| Income | |

| Wages, Tips, Other Compensation | W-2 box 1 |

| Self-employment Gross Income | |

| Pension or Other Taxable Retirement Benefits | |

| Unemployment Compensation | |

| Retirement Income | Social Security Income, etc. |

| Scholarship or Grant as Income | |

| Investment and Interest Income | |

| Other Types of Income | |

| Adjustments To Income | |

| Student Loan Interest | |

| Qualified Educator Expenses | |

| IRA Contributions (Not Payroll Deductions) | |

| HSA Contributions (Not Payroll Deductions) | |

| Alimony Paid | |

| Other Adjustments | |

Data Retrieved From: https://apps.irs.gov/app/freeFile/general/

Common Adjustments to Income

Adjustments to income are specific deductions that can be subtracted from gross income to arrive at your Adjusted Gross Income (AGI). These adjustments are beneficial because they reduce the amount of income that is subject to federal income tax. Below is a comprehensive breakdown of common adjustments recognized by the IRS:

Self-Employment Tax Relief

- Definition: Self-employed individuals pay both the employer and employee portions of Social Security and Medicare taxes, known collectively as self-employment tax.

- Adjustment Detail: Half of the self-employment tax paid is deductible from gross income. This adjustment helps to alleviate the burden of dual tax responsibilities for the self-employed.

- Tax Form: Reported and calculated on Schedule SE, and the deductible part is adjusted on Form 1040.

Health Insurance Premiums for Self-Employed

- Definition: Premiums paid for medical, dental, and long-term care insurance for self-employed individuals, their spouses, and dependents.

- Adjustment Detail: The total amount paid for health insurance premiums can often be deducted, provided the individual is not eligible to participate in a subsidized health plan offered by an employer or a spouse’s employer.

- Tax Form: Deduction is taken directly on Form 1040, not as an itemized deduction on Schedule A.

Retirement Contributions (e.g., Traditional IRA)

- Definition: Contributions to traditional Individual Retirement Accounts (IRAs) or other qualified retirement plans.

- Adjustment Detail: Contributions to a traditional IRA are often deductible up to a certain limit, which varies annually and can depend on income, filing status, and coverage by other retirement plans.

- Tax Form: Contributions are reported and the deduction is claimed on Form 1040 or 1040-SR.

Student Loan Interest

- Definition: Interest paid on a qualified student loan used for higher education.

- Adjustment Detail: Up to $2,500 of the interest paid annually can be deducted, depending on the taxpayer’s income level and filing status.

- Tax Form: Deduction is claimed on Form 1040, and lenders usually provide Form 1098-E to report how much interest was paid throughout the year.

Educator Expenses

- Definition: Out-of-pocket classroom expenses paid by teachers and other eligible educators.

- Adjustment Detail: Educators can deduct up to $250 ($500 if married filing jointly and both spouses are eligible educators) of unreimbursed expenses including books, supplies, and other materials used in the classroom.

- Tax Form: Deduction is claimed directly on Form 1040.

Other Eligible Adjustments as Per the Latest Tax Codes

- Alimony Paid: For divorce agreements finalized before 2019, alimony payments are deductible from gross income for the payer.

- Moving Expenses for Members of the Armed Forces: Active duty military members moving due to a military order can deduct certain moving expenses.

- Penalty on Early Withdrawal of Savings: Penalty incurred for early withdrawal from a certificate of deposit or other deferred interest account can be deducted.

- HSA Contributions: Contributions to a Health Savings Account are deductible, up to the legal limit.

Calculating Your Adjusted Gross Income (AGI)

Calculating your Adjusted Gross Income (AGI) is an essential step in preparing your tax return. This figure is critical as it determines your eligibility for various tax deductions and credits. Here is a step-by-step guide on how to calculate your AGI, accompanied by a conceptual flowchart to visualize the process.

Step 1: Identifying Total Income

To begin, you must compile all sources of income for the fiscal year. This includes:

- Wages and Salaries: Sum of all earnings from employment (Form W-2).

- Interest and Dividends: Total interest from bank accounts and dividends from investments (Forms 1099-INT and 1099-DIV).

- Capital Gains: Profits from the sale of assets such as stocks and real estate (Schedule D).

- Business Income: Net income from any business operations if self-employed (Schedule C).

- Retirement Distributions: Total withdrawals from retirement accounts like 401(k)s and IRAs (Form 1099-R).

- Other Income: Includes rental income, alimony received, unemployment compensation, and any other miscellaneous income (various forms).

Step 2: Listing Applicable Deductions

Next, identify the adjustments you can legally make to your total income. These adjustments include:

- Self-Employment Tax Deduction: Half of the self-employment taxes paid.

- Educator Expenses: Up to $300 for classroom supplies if you are a qualified educator.

- Student Loan Interest: Up to $2,500 of interest paid on student loans.

- IRA Contributions: Deductible contributions made to your traditional IRA.

- Health Insurance Premiums for Self-Employed: Premiums paid for health insurance if you’re self-employed.

- Other Deductions: Other eligible adjustments such as alimony paid (for divorces finalized before 2019) and HSA contributions.

Step 3: Subtracting Deductions from Total Income to Find AGI

Once you have your total income and your list of applicable deductions:

- Calculate Total Deductions: Add up all the adjustments to income you’ve listed.

- Determine AGI: Subtract the total of these deductions from your total income.

AGI = Total Income − Total Adjustments to Income

This final figure is your Adjusted Gross Income, which will be used on your tax return to determine further deductions, your tax liability, and your eligibility for additional credits.

Importance of AGI in Tax Documentation

Adjusted Gross Income (AGI) is a pivotal figure in U.S. tax documentation, serving as a keystone for many aspects of tax filing and financial planning. Understanding its role can help taxpayers navigate the complexities of their tax responsibilities more effectively. Below, we explore the significance of AGI in determining tax liability, its influence on eligibility for tax benefits, and provide an example scenario to illustrate its impact.

Role of AGI in Determining Tax Liability

AGI is fundamentally important in the calculation of tax liability for several reasons:

- Basis for Taxable Income: AGI is the baseline figure from which the Standard Deduction or Itemized Deductions are subtracted to determine your taxable income. Lower taxable income generally results in lower tax liability.

- Tax Rate Application: The U.S. tax system is progressive, meaning tax rates increase as income increases. AGI helps in placing taxpayers into their appropriate tax brackets, which in turn determines the rate at which their income will be taxed.

Influence on Eligibility for Various Tax Credits and Deductions

AGI directly affects the availability and the amount of several tax credits and deductions, which can significantly reduce overall tax liability:

- Eligibility Thresholds: Many credits and deductions have phase-out thresholds based on AGI. This means higher AGIs may reduce the amount of credits like the Child Tax Credit, Education Credits, and the Earned Income Tax Credit, or even render the taxpayer ineligible.

- Medical Expenses Deduction: Taxpayers who itemize deductions can deduct medical expenses exceeding a certain percentage of their AGI, which for 2024 is set at 7.5% of AGI.

- Miscellaneous Deductions: Various other deductions, including certain types of investment losses, also hinge on percentages of AGI, further illustrating its importance in tax strategy.

Example Scenario: Filing Status and Its Impact on AGI

Scenario: Consider two scenarios for a hypothetical couple, John and Jane, to illustrate the impact of filing status on AGI and subsequent tax implications.

Married Filing Jointly: John and Jane have a combined gross income of $120,000, with $20,000 in adjustments to income, resulting in an AGI of $100,000. Filing jointly may avail them of higher income thresholds for tax brackets and certain tax credits, reducing their overall tax liability compared to filing separately.

Married Filing Separately: If they choose to file separately, each might report $60,000 in gross income and $10,000 in adjustments, leading each to an AGI of $50,000. This filing status may be beneficial if one partner has significant medical expenses or miscellaneous individual deductions since these deductions are limited by AGI.

Illustration: AGI and Tax Benefits

- Child Tax Credit: For 2024, the full Child Tax Credit is available to married couples filing jointly with an AGI of up to $400,000, and phases out quickly above that. By keeping their AGI within this limit through strategic deductions, John and Jane can maximize their credit.

- Education Credits: Similarly, the American Opportunity Tax Credit and Lifetime Learning Credit have phase-out thresholds based on AGI, which can influence decisions on how much to contribute to retirement accounts or whether to claim other potential adjustments.

Where to Find AGI on Tax Forms

Understanding where to find your Adjusted Gross Income (AGI) on tax forms is crucial for accurately filing your taxes and ensuring you are calculating your tax responsibilities correctly. The primary form where you can locate your AGI is the IRS Form 1040, the standard federal income tax form used to report an individual’s gross income. Here’s a detailed look at where to find your AGI and explanations of other relevant lines and schedules that relate to your AGI.

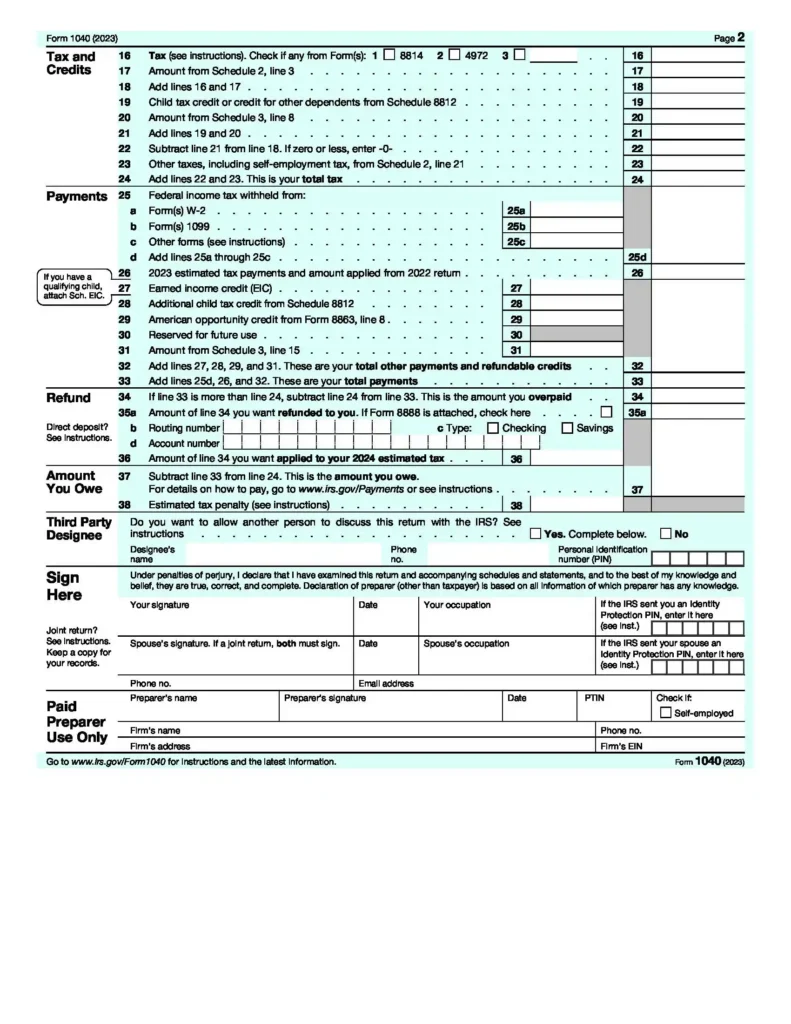

Locating AGI on Form 1040

Form 1040 is structured to help you calculate your taxable income after adjustments and deductions. As of the 2024 tax year, your AGI can be found in the following section:

- Line 11: This line presents your AGI. It is the sum of all income minus the adjustments to income, which are reported on Schedule 1 attached to your Form 1040. To see your specific adjustments and how they compile to form your AGI, you will need to review the detailed entries on Schedule 1.

Visual Guide: Form 1040 Layout

Income Section: Lines 1 through 9a

- These lines are used to report various types of income including wages, salaries, taxable interest, dividends, and retirement distributions. Each type of income has a designated line on Form 1040.

Adjustments to Income: Schedule 1, Lines 1 through 22

- Adjustments such as educator expenses, student loan interest deduction, and IRA contributions are reported here. These amounts are then summarized and the total adjustment is recorded on Line 10a of Form 1040.

Calculating AGI: Line 11 on Form 1040

- After reporting total income and summarizing adjustments on Schedule 1, these figures are used in Line 11 to calculate the AGI. Total income minus the total adjustments (from Schedule 1) equals your AGI.

Other Relevant Lines and Schedules Related to AGI

Several other lines and schedules on and attached to your Form 1040 are impacted by or contribute to your AGI:

Schedule 1: This schedule is essential as it details additional income and adjustments to income not listed directly on Form 1040. Types of income reported here include business income, alimony received, and unemployment compensation. Adjustments to income are also detailed on this schedule.

Schedule A (Itemized Deductions): If you choose to itemize deductions, Schedule A will be used to list expenses such as medical and dental, taxes paid, interest paid, and gifts to charity. These deductions do not directly change your AGI but are subtracted from AGI to determine your taxable income.

Schedule D (Capital Gains and Losses): If you have sold assets like stocks or property, this schedule helps calculate the capital gains or losses, which affect the income section of Form 1040.

Form 1040 U.S Individual Income Tax Return 2023 (Page 1)

Image Retrieved From: https://www.irs.gov/pub/irs-pdf/f1040.pdf

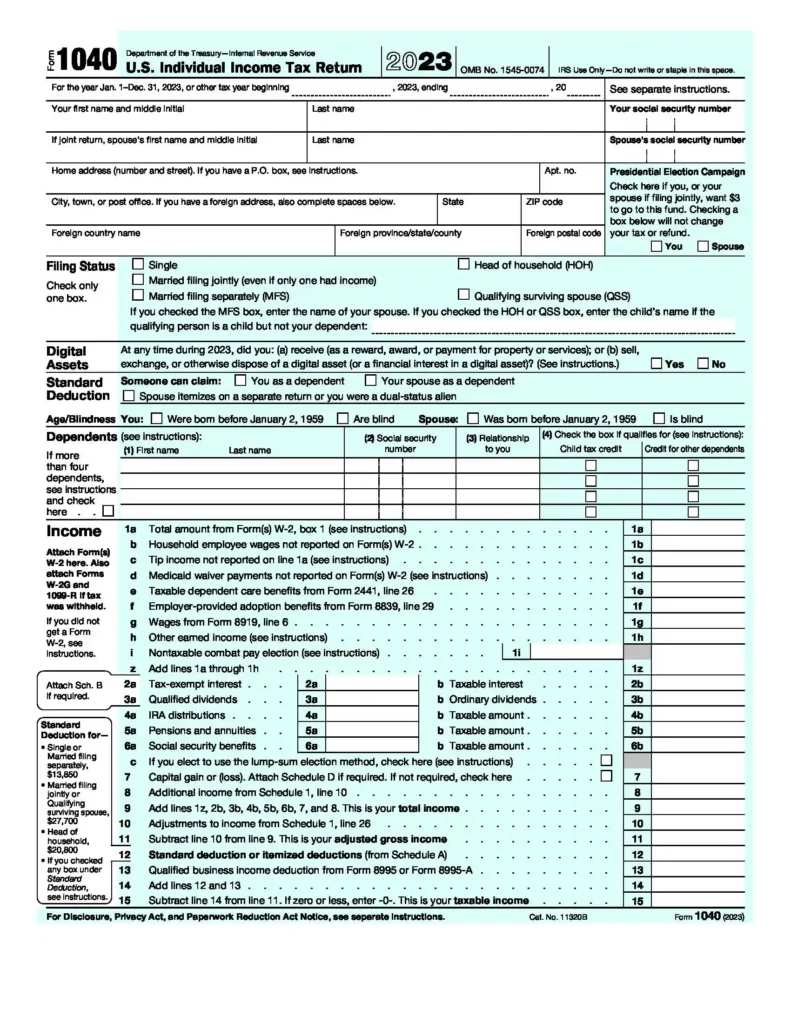

Form 1040 U.S Individual Income Tax Return 2023 (Page 2)

Image Retrieved From: https://www.irs.gov/pub/irs-pdf/f1040.pdf

Frequently Asked Questions About Adjusted Gross Income (AGI)

How do I calculate my adjusted gross income?

To calculate your Adjusted Gross Income (AGI), start by summing up all your sources of income to get your total gross income. This includes wages, salaries, interest, dividends, alimony, rental income, and more. Then, subtract any eligible adjustments to income such as IRA contributions, student loan interest, or educator expenses. The formula is: AGI = Total Income – Adjustments to Income.

Is adjusted gross income the same as net income?

No, adjusted gross income (AGI) and net income are not the same. AGI refers to your total gross income minus specific IRS-allowed deductions, and is used to determine your taxable income and eligibility for certain tax credits. Net income, often referred to in business contexts, is what remains after all expenses have been deducted from gross income, including taxes and operating expenses.

How do I find my AGI?

You can find your AGI on your last filed tax return. On the IRS Form 1040, it is listed on Line 11. If you need to retrieve this information from a previous year, you can request a tax transcript from the IRS or consult your tax preparation software.

What is an example of adjusted gross income?

Suppose you earned a salary of $50,000, received $2,000 in dividends, and $3,000 from rental income, summing your total income to $55,000. If you made a $3,000 contribution to an IRA and paid $1,000 in student loan interest, your AGI would be: $55,000 (total income) – $4,000 (adjustments) = $51,000 AGI.

What is the difference between net income and gross income?

Gross income is the total income earned before any deductions or taxes are applied. Net income refers to the amount of income left after all deductions, including taxes and other withholdings, are subtracted from the gross income. In personal finance, net income is what you actually take home.

How to calculate taxable income?

To calculate taxable income, take your AGI and subtract either the standard deduction or the total itemized deductions (whichever is higher), and any other allowable exemptions. This final number is what your income taxes will be based on.

Why was my tax return rejected because of AGI?

If your tax return was rejected due to AGI issues, it typically means the AGI you entered does not match the IRS records, possibly from a previous year’s tax filing. To correct this, double-check your previous year’s return for the correct AGI or obtain a tax transcript from the IRS for accurate figures.

How to get last year's tax return?

You can obtain a copy of last year’s tax return by using the IRS’s “Get Transcript” tool online, by mailing a completed Form 4506-T to the IRS, or by calling the IRS. These methods will provide you with a transcript of your return, which includes most of the line items, including your AGI.

Can adjusted gross income be higher than gross income?

No, AGI cannot be higher than gross income as it is calculated by subtracting certain deductions from your gross income.

What is the gross monthly income?

Gross monthly income is the total amount of money you earn in a month before any deductions like taxes, social security, retirement contributions, etc., are taken out.

What is the difference between adjusted gross income and taxable income?

Adjusted Gross Income (AGI) is your gross income after adjustments like IRA contributions, student loan interest, etc., are subtracted. Taxable income is what remains after subtracting either the standard or itemized deductions from your AGI.

How to reduce your taxable income?

You can reduce your taxable income by increasing contributions to retirement accounts, utilizing health savings accounts, deducting mortgage interest, making charitable donations, and taking advantage of tax credits and deductions for which you are eligible.

What is the standard deductible?

The standard deduction is a set amount that the IRS allows taxpayers to deduct from their AGI to reduce their taxable income. It varies based on filing status (e.g., single, married filing jointly) and is adjusted annually for inflation.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

Trusted By

Trusted by 3.2M+ Employees: 21 Years of Service Across Startups to Fortune 500 Enterprises

Join our ever-growing community of satisfied customers today and experience the unparalleled benefits of TimeTrex.

Strength In Numbers

Join The Companies Already Benefiting From TimeTrex

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.