ABA Routing Numbers

US ABA Routing Numbers on a Check

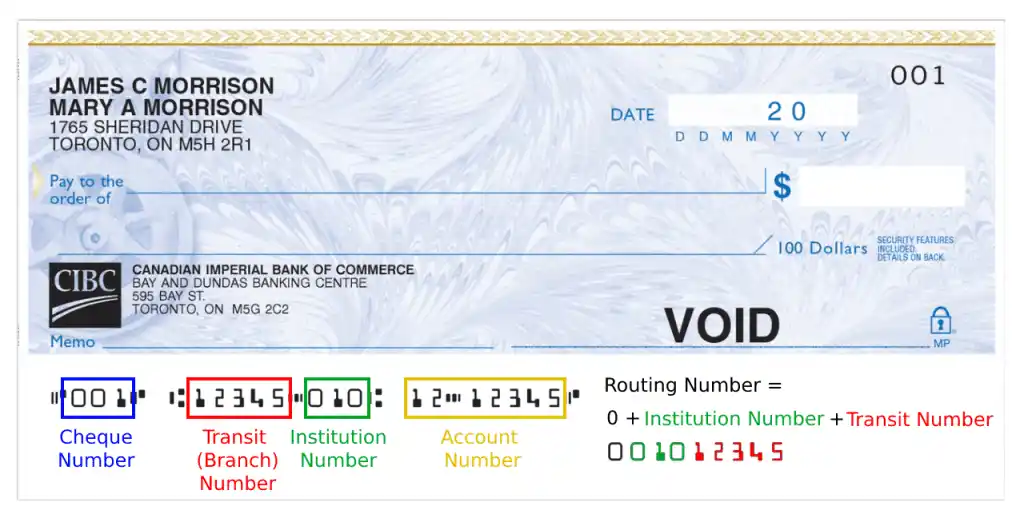

US Routing Numbers on a Canadian Cheque

Canadian cheques incorporate a version of the U.S. routing number system to facilitate electronic fund transfers (EFT). These numbers are structured to include a leading zero, making them 9 digits long to align with the U.S. format. The components of a Canadian routing number are:

- Leading Zero (0): Added to extend the length to 9 digits, matching the U.S. system.

- Institution Number (3 digits): Identifies the bank, such as “010” for CIBC.

- Transit Number (5 digits): Specifies the branch location where the account is held.

For example, a typical electronic routing number could be 0-12345-010. However, for paper-based transactions like cheques, which use magnetic ink character recognition (MICR), the format is slightly different, featuring 8 digits as “12345-010”. These routing numbers are crucial for various banking transactions including direct deposits, bill payments, and ensuring efficient processing of funds both domestically and across borders. Changes in these numbers can occur with changes in bank branches or bank mergers, with customers typically notified by their bank of any change.

What are ABA Routing Numbers?

ABA Routing Numbers, formally known as the American Bankers Association (ABA) Routing Numbers, are unique codes consisting of nine digits that identify financial institutions within the United States. These numbers were introduced in 1910 by the American Bankers Association as a way to streamline the processing of paper checks and make it easier to sort, bundle, and ship them to the drawer’s bank for debiting. Over time, their use has expanded beyond paper checks to include a wide variety of electronic transactions and financial services.

Origin and Purpose

The ABA Routing Number system was developed to address the complexity of the banking industry’s growth. As banks proliferated across the country, a system to accurately identify each institution became essential for efficient operations. The ABA Routing Number serves this purpose, acting as a financial GPS that ensures transactions are directed to the correct bank.

Structure of ABA Routing Numbers

Each ABA Routing Number is a unique sequence that provides detailed information about the bank it represents. The first four digits are the Federal Reserve Routing Symbol, indicating the Federal Reserve district where the bank is located. The next four digits are the ABA Institution Identifier, which specifies the specific bank. The final digit is a check digit, calculated through a formula that validates the routing number’s authenticity.

Key Functions

Check Processing: Initially, ABA Routing Numbers were used primarily for processing checks. They allowed banks and clearinghouses to quickly determine where a check originated, facilitating faster and more accurate processing.

Electronic Payments: Today, these numbers play a crucial role in the execution of electronic payments, including direct deposits, bill payments, and automated clearing house (ACH) transactions. They ensure that money is accurately transferred between banks without physical movement of checks.

Wire Transfers: For domestic wire transfers, ABA Routing Numbers help identify the receiving bank. They guide the path for funds to be securely and efficiently transferred from one bank to another.

Online Banking: In the digital age, ABA Routing Numbers are essential for setting up direct deposits, automatic bill payments, and managing various online banking transactions.

Introduction to ABA Routing Numbers

The American Bankers Association (ABA) Routing Number is a fundamental component of the banking and financial industries in the United States, serving as a critical identifier for financial institutions. This section provides a detailed look into the history, definition, structure, and significance of ABA Routing Numbers, shedding light on their pivotal role in modern finance.

Brief History and Development of ABA Routing Numbers

The concept of the ABA Routing Number was introduced in 1910 by the American Bankers Association, marking a significant milestone in the evolution of the banking industry. The inception of these numbers was driven by the need to improve the efficiency and reliability of processing paper checks, which, at the time, were the primary method of non-cash payment. As banks proliferated across the country, each with its own policies and processes, the financial system needed a standardized method to identify institutions and route transactions accordingly.

The introduction of ABA Routing Numbers revolutionized banking practices, allowing banks and clearinghouses to quickly and accurately process checks by directing them to the appropriate institutions for debiting. Over the years, as technology advanced and the financial landscape evolved, the use of ABA Routing Numbers expanded beyond paper checks to encompass a wide array of electronic transactions, including wire transfers, electronic funds transfers (EFTs), and automated clearing house (ACH) transactions.

Definition and Structure of an ABA Routing Number

An ABA Routing Number is a unique nine-digit code that identifies a specific financial institution within the United States. This code is assigned by the American Bankers Association and is used to direct financial transactions to the correct bank.

The structure of an ABA Routing Number is carefully designed to include specific information about the bank it represents:

- Federal Reserve Routing Symbol (First Four Digits): Indicates the Federal Reserve Bank district where the financial institution is located. Each district is assigned a range of numbers, making it possible to identify the bank’s geographical location.

- ABA Institution Identifier (Next Four Digits): Specifies the unique identification of the financial institution within the Federal Reserve district.

- Check Digit (Last Digit): Serves as a form of error-checking to ensure the routing number is valid. It is calculated through a specific formula that uses the first eight digits of the routing number.

Importance of ABA Routing Numbers in Banking and Finance

ABA Routing Numbers are indispensable to the banking and finance sectors for several reasons:

- Efficient Processing of Transactions: They enable the fast and accurate processing of a vast volume of transactions daily, from paper checks to electronic payments.

- Enhanced Security: By accurately identifying financial institutions, routing numbers help prevent errors and fraud in transactions, ensuring that funds reach their intended destinations securely.

- Facilitation of Electronic Transactions: In the digital age, ABA Routing Numbers are crucial for managing electronic transactions, including direct deposits, online payments, and wire transfers, thereby supporting the growing trend towards cashless payments.

- Regulatory Compliance: They assist banks in complying with federal and state regulations concerning the processing of financial transactions, helping to maintain the integrity of the banking system.

The Purpose of ABA Routing Numbers

ABA Routing Numbers serve as the backbone of the American banking system, ensuring the smooth execution of countless financial transactions daily. These nine-digit codes are not just random numbers; they are meticulously designed to fulfill several critical functions in the banking and finance sectors. This section delves into the multifaceted purposes of ABA Routing Numbers, highlighting their significance in facilitating bank transactions, differentiating financial institutions, and more.

Facilitating Bank Transactions

One of the primary functions of ABA Routing Numbers is to facilitate the efficient processing of bank transactions. These numbers allow banks to quickly and accurately route payments, withdrawals, and deposits to and from the correct institutions. Whether it’s a check being deposited at a bank branch or an online payment, the ABA Routing Number ensures that the transaction is directed to the right place, reducing the risk of errors and delays. This system is vital for maintaining the speed and reliability of financial transactions in a complex banking network.

Differentiating Between Financial Institutions

With thousands of banks and credit unions operating in the United States, each with its unique policies and operations, the ABA Routing Number serves as an essential identifier that differentiates one financial institution from another. This differentiation is crucial not only for routing transactions accurately but also for maintaining the integrity of the financial system. By assigning a unique number to each bank, the system prevents confusion and ensures that each institution is clearly identifiable, facilitating smoother transactions and communication between banks.

Role in Direct Deposits and Automatic Payments

ABA Routing Numbers play a crucial role in setting up and managing direct deposits and automatic payments. For employees receiving their salaries via direct deposit, or consumers setting up recurring bill payments for utilities, mortgages, or insurance premiums, the ABA Routing Number is required to ensure that the funds are accurately directed to the correct bank account. This automation of payments is not only convenient for individuals and businesses but also promotes efficiency and reliability in the payment system, reducing the need for paper checks and manual processing.

Use in Electronic Funds Transfers (EFTs) and Wire Transfers

In the realm of electronic funds transfers (EFTs), including wire transfers, ABA Routing Numbers are indispensable. These numbers facilitate the electronic movement of money between banks, both within the United States and internationally. For domestic transactions, the ABA Routing Number identifies the recipient bank, ensuring that the funds are sent to the correct location. In the case of international wire transfers, the ABA Routing Number may be used in conjunction with other international banking codes, such as SWIFT codes, to route the funds accurately across borders. This capability is crucial for businesses and individuals who need to transfer funds quickly and securely around the globe.

How to Find Your ABA Routing Number

Whether you’re setting up direct deposit, making a wire transfer, or initiating an electronic payment, knowing your ABA Routing Number is essential. Fortunately, there are several straightforward methods to find this critical piece of banking information. This section outlines the most common ways to locate your ABA Routing Number, ensuring that your financial transactions proceed smoothly and accurately.

On Your Checkbook

One of the easiest ways to find your ABA Routing Number is by looking at your checkbook. On a standard personal check, the ABA Routing Number is the nine-digit code located at the bottom left corner, just before your account number. It’s often printed with magnetic ink, in a font that allows both people and machines to read it easily. The sequence starts with the routing symbol (⑆), followed by the nine digits, and ends with the transit symbol (⑇). This method is quick and reliable, as the number on your checks is specific to your bank branch and account.

Through Your Online Banking Portal

With the advent of online banking, most financial institutions now offer the option to find your ABA Routing Number through their online portals or mobile apps. After logging into your account, navigate to the account information or details section. Many banks provide the routing number prominently within this area, often under “Account Details,” “Account Information,” or a similar heading. Some banks also include the routing number in the FAQs or help sections of their online banking platform, making it easily accessible without having to comb through your account details.

Contacting Customer Service

If you’re unable to find your ABA Routing Number online or don’t have a checkbook handy, another reliable method is to contact your bank’s customer service. You can find the customer service number on the back of your bank card, through the bank’s official website, or within your online banking portal. A customer service representative can provide you with the routing number after verifying your identity. This method not only gets you the information you need but also ensures that you’re getting the correct number directly from your bank.

Websites of Major Banks

Many major banks publish their ABA Routing Numbers on their official websites. This can be particularly handy if you’re unable to access your online banking account or prefer not to wait on hold for customer service. Typically, banks will have a page dedicated to routing numbers, categorized by state or type of transaction (e.g., paper transactions, electronic transactions, wire transfers). It’s important to ensure you’re selecting the correct routing number for your specific needs, as some banks have multiple routing numbers depending on the nature of the transaction and the location of the account.

Decoding an ABA Routing Number

The ABA Routing Number is a 9-digit code that plays a crucial role in identifying specific financial institutions within the United States and facilitating the accurate processing of financial transactions. Each digit in this sequence has a particular purpose, revealing detailed information about the bank it represents. This section decodes the structure of the ABA Routing Number, providing insight into its composition and the significance of each part.

Explanation of the 9-Digit Structure

The ABA Routing Number is meticulously structured, with each of the nine digits serving a distinct function. This structure is standardized to ensure consistency and accuracy across all financial transactions. Here’s a broad overview of what each segment represents:

- Federal Reserve Routing Symbol (First Four Digits): Indicates the Federal Reserve district and the type of financial institution.

- ABA Institution Identifier (Next Four Digits): Specifies the unique identification of the financial institution within the Federal Reserve district.

- Check Digit (Last Digit): Provides a way to verify the authenticity of the entire routing number.

Breakdown of Each Section and Its Meaning

Federal Reserve Routing Symbol (First Four Digits):

- First Two Digits: The first two digits correspond to the 12 Federal Reserve Banks and their districts. The numbers range from 01 to 12, each representing a specific geographic area in the U.S. For example, a routing number beginning with “01” might indicate a bank in the Boston Federal Reserve District, while “12” could represent a bank in the San Francisco Federal Reserve District.

- Third Digit: The third digit, when combined with the first two, indicates the Federal Reserve check processing center assigned to the bank.

- Fourth Digit: The fourth digit signifies the state of the bank within the Federal Reserve district. In cases where a single state is covered by more than one district, this digit helps distinguish the specific district within the state.

ABA Institution Identifier (Next Four Digits):

This section of the routing number is assigned by the American Bankers Association and uniquely identifies the bank within its Federal Reserve district. The combination of these four digits ensures that each bank, regardless of its size or location, can be distinctly recognized in the banking network. This is critical for routing transactions to and from the right institutions without confusion.

Check Digit (Last Digit):

The final digit of the ABA Routing Number is a check digit, which is calculated through a specific algorithm involving the first eight digits. This digit serves as a form of error detection, ensuring that the routing number is valid and has been entered correctly. The check digit algorithm is designed to catch common types of input errors, such as transpositions or mistyping, enhancing the security and reliability of transaction processing.

The Difference Between ABA Routing Numbers and Other Financial Codes

In the complex landscape of global finance, various codes and numbers are used to identify banks and facilitate transactions. Among these, ABA Routing Numbers, SWIFT codes, IBAN numbers, and MICR numbers play pivotal roles. Understanding the differences between these codes is crucial for ensuring that financial transactions are processed smoothly and accurately, whether they’re local or international. This section delves into the distinctions between ABA Routing Numbers and other significant financial codes, highlighting their unique purposes and when to use each.

ABA vs. SWIFT Codes

ABA Routing Numbers are specific to the United States and are used to identify financial institutions within its banking system. They are essential for domestic transactions, including check processing, wire transfers, and electronic payments.

SWIFT Codes (Society for Worldwide Interbank Financial Telecommunication Codes), also known as BIC (Bank Identifier Codes), are used for international transactions. They are an international standard for identifying banks across the globe, facilitating cross-border payments by ensuring funds reach the correct institution in any country.

- When to Use: Use ABA Routing Numbers for transactions within the United States. Use SWIFT codes for international wire transfers and when sending or receiving money from foreign banks.

ABA vs. IBAN Numbers

IBAN Numbers (International Bank Account Numbers) are used internationally to identify individual bank accounts across national borders. Unlike ABA Routing Numbers that identify the bank and branch, IBANs provide detailed information, including the country, bank, and specific account number, making them essential for international money transfers.

- When to Use: ABA Routing Numbers are necessary for domestic transactions within the U.S. IBAN numbers are required for most international transfers to and from countries that adopt the IBAN system, ensuring that international payments are directed to the correct account.

ABA vs. MICR Numbers

MICR Numbers (Magnetic Ink Character Recognition Numbers) include the ABA Routing Number, account number, and check number printed at the bottom of checks. The ABA Routing Number within the MICR line is used for sorting and routing checks to the correct bank. The entire MICR line, however, facilitates the processing and clearance of checks, combining the bank’s identification with the account and check number for transaction processing.

- When to Use: The ABA Routing Number is used for electronic or wire transactions and identifying financial institutions within the U.S. The full MICR line is specific to the physical processing of checks, enabling automated check handling and sorting.

When to Use Each Type of Code

- ABA Routing Numbers: Use for all domestic transactions within the United States, including direct deposits, electronic payments, and check processing.

- SWIFT Codes: Necessary for international wire transfers, enabling identification of banks globally for cross-border payments.

- IBAN Numbers: Required for international transactions in countries that participate in the IBAN system, ensuring payments reach the correct bank account across national borders.

- MICR Numbers: Used in the physical processing and clearance of paper checks within the banking system, incorporating ABA Routing Numbers for bank identification.

ABA Routing Numbers for International Transfers

While ABA Routing Numbers primarily serve the United States banking system for domestic transactions, their role extends into the realm of international banking under certain circumstances. Understanding how these numbers are utilized in international transactions, the function of correspondent banks, and the relationship between ABA Routing Numbers and SWIFT codes is essential for anyone involved in global financial operations. This section explores these aspects in detail, providing insight into the intricacies of international banking mechanisms.

How ABA Routing Numbers are Used in International Transactions

ABA Routing Numbers are fundamentally designed for the U.S. banking system and are not directly used for international wire transfers in the same way SWIFT codes are. However, they become relevant in international contexts in two primary scenarios:

When Funds are Sent from Abroad to a U.S. Bank Account: For international transfers coming into the U.S., the sender might need to provide the ABA Routing Number of the recipient’s U.S. bank along with the recipient’s account number. This ensures that the international banking system can interface with the domestic U.S. system, directing the funds to the correct bank.

Through Correspondent Banking: U.S. banks may use their ABA Routing Numbers in conjunction with correspondent banks that have international capabilities. This setup allows for the indirect participation of U.S. banks in the global transfer system.

The Role of Correspondent Banks

Correspondent banks act as intermediaries between two financial institutions that do not have a direct relationship or are in different countries. They facilitate international transactions in several ways:

- Converting Currencies: When a transfer involves currency exchange, correspondent banks can convert the funds into the desired currency before completing the transfer.

- Providing Access to Foreign Markets: They allow banks without international presence or capabilities to access foreign financial networks. A U.S. bank might use a correspondent bank to send funds internationally on behalf of its customer, using the correspondent’s SWIFT code for the transaction.

- Serving as a Bridge: For transactions coming into the U.S., correspondent banks may receive funds via SWIFT and then use the ABA Routing Number of the destination bank to complete the transfer domestically.

SWIFT Codes and Their Relationship with ABA Routing Numbers

SWIFT codes (or BICs) are the primary mechanism used for identifying financial institutions in international transactions. They play a crucial role in the global financial system, facilitating cross-border payments and communications between banks. The relationship between SWIFT codes and ABA Routing Numbers is characterized by their complementary functions in international transfers involving U.S. banks:

- Complementary Use: In transactions where funds are sent from a foreign country to a U.S. bank, the SWIFT code identifies the sending or intermediary bank internationally, while the ABA Routing Number identifies the receiving bank within the U.S. This combination ensures the seamless transfer of funds across borders.

- Interbank Communications: SWIFT codes are also used for sending messages and instructions between banks, including those related to transactions that involve ABA Routing Numbers for the final delivery of funds within the United States.

FAQ: ABA Routing Numbers

Can ABA Routing Numbers Change?

Yes, ABA Routing Numbers can change. Banks may undergo mergers, acquisitions, or reorganizations that necessitate a change in their routing numbers. Additionally, banks may also change routing numbers as they open new branches or restructure their operations. Customers are typically notified of any changes to their bank’s routing number well in advance.

What Happens if You Use the Wrong ABA Routing Number?

Using the wrong ABA Routing Number for a transaction can result in delays, returns, or the misrouting of funds. For example, a payment might be returned to the sender, or, in some cases, deposited into the wrong account. It’s crucial to double-check routing numbers before executing transactions to avoid such issues.

Are ABA Routing Numbers Public Information?

Yes, ABA Routing Numbers are public information. They can be found on checks, bank websites, and through online banking portals. While routing numbers are not sensitive information, the account number and other personal details should be kept secure to prevent unauthorized access to one’s finances.

Can I Have Multiple ABA Routing Numbers?

Yes, it’s possible for an individual to have accounts with multiple ABA Routing Numbers if they bank with different institutions or if their bank assigns different routing numbers for different types of transactions (such as electronic vs. paper transactions) or branches.

How Are ABA Routing Numbers Assigned?

The American Bankers Association assigns ABA Routing Numbers in accordance with the Routing Number Administrative Board’s policies. The assignment is based on the bank’s location and sometimes its operation (e.g., electronic transactions or check processing).

Is There a Difference Between ABA Routing Numbers for Wire Transfers and ACH Transactions?

Yes, some banks may use different ABA Routing Numbers for wire transfers and ACH transactions. While many banks use the same routing number for all types of transactions, it’s important to verify the correct routing number for the specific transaction type.

How Do I Verify a Bank’s ABA Routing Number?

To verify a bank’s ABA Routing Number, you can use the ABA’s online lookup tool, check the bank’s official website, or contact the bank directly. It’s important to ensure the routing number is correct, especially for transactions like wire transfers that may incur fees if misdirected.

Can International Banks Have ABA Routing Numbers?

International banks do not have ABA Routing Numbers since these numbers are specific to U.S. financial institutions. However, international banks that operate branches in the U.S. may have ABA Routing Numbers for those branches to facilitate domestic transactions within the United States.

How Do ABA Routing Numbers Support Mobile and Online Banking?

ABA Routing Numbers are used in mobile and online banking transactions the same way they are used in traditional banking transactions. They identify the financial institution and ensure that electronic payments, direct deposits, and other digital transactions are processed accurately.

What’s the Future of ABA Routing Numbers in the Digital Age?

Despite the evolution of digital banking, ABA Routing Numbers continue to play a crucial role in identifying financial institutions and routing transactions. As banking becomes increasingly digital, these numbers will likely remain a foundational element of the financial infrastructure, facilitating both traditional and emerging forms of payment.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

Trusted By

Trusted by 3.2M+ Employees: 21 Years of Service Across Startups to Fortune 500 Enterprises

Join our ever-growing community of satisfied customers today and experience the unparalleled benefits of TimeTrex.

Strength In Numbers

Join The Companies Already Benefiting From TimeTrex

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.