Guide to US State Sales Tax Holidays

Save money with tax-free shopping events throughout the year

What Are Sales Tax Holidays?

Sales tax holidays are limited time periods when states temporarily exempt specific products from state (and sometimes local) sales taxes. These tax-free periods provide consumers with an opportunity to purchase eligible items without paying sales tax, resulting in immediate savings. First introduced in New York in 1997, sales tax holidays have since been adopted by many states as a way to stimulate economic activity and provide tax relief to consumers.

Types of Sales Tax Holidays

Back-to-School

Exempts items like clothing, footwear, school supplies, and computers. Typically held in July or August before the school year begins.

Disaster Preparedness

Exempts emergency supplies like generators, batteries, and flashlights. Usually occurs before hurricane or severe weather seasons.

Energy Efficient

Provides tax exemptions for ENERGY STAR appliances and other energy-saving products to encourage eco-friendly purchases.

Second Amendment

Exempts firearms, ammunition, and hunting supplies in select states like Mississippi and Louisiana.

Key Benefits of Tax Holidays

- Provide direct tax relief to consumers

- Help families save on essential purchases

- Boost local retail sales during specific periods

- Increase foot traffic for brick-and-mortar retailers

- Support economic activity in participating states

Economic Impact of Sales Tax Holidays

Sales tax holidays impact both consumers and retailers in various ways. While they offer immediate savings for shoppers, their economic effects are multifaceted:

Consumer Benefits

- Immediate savings of 4-10% (depending on state tax rates)

- Predictable shopping opportunities for planned purchases

- Particularly beneficial for low and middle-income families

- Savings on essential items like clothing and school supplies

Retailer Considerations

- Increased customer traffic during holiday periods

- Administrative costs for implementing tax exemptions

- Potential for increased sales of non-exempt items

- Opportunity for promotional tie-ins with tax holidays

Revenue Impact for States

According to research from the Institute on Taxation and Economic Policy, sales tax holidays will cost states and localities over $1.3 billion in lost revenue in 2024. However, proponents argue this is offset by increased economic activity and sales of non-exempt items.

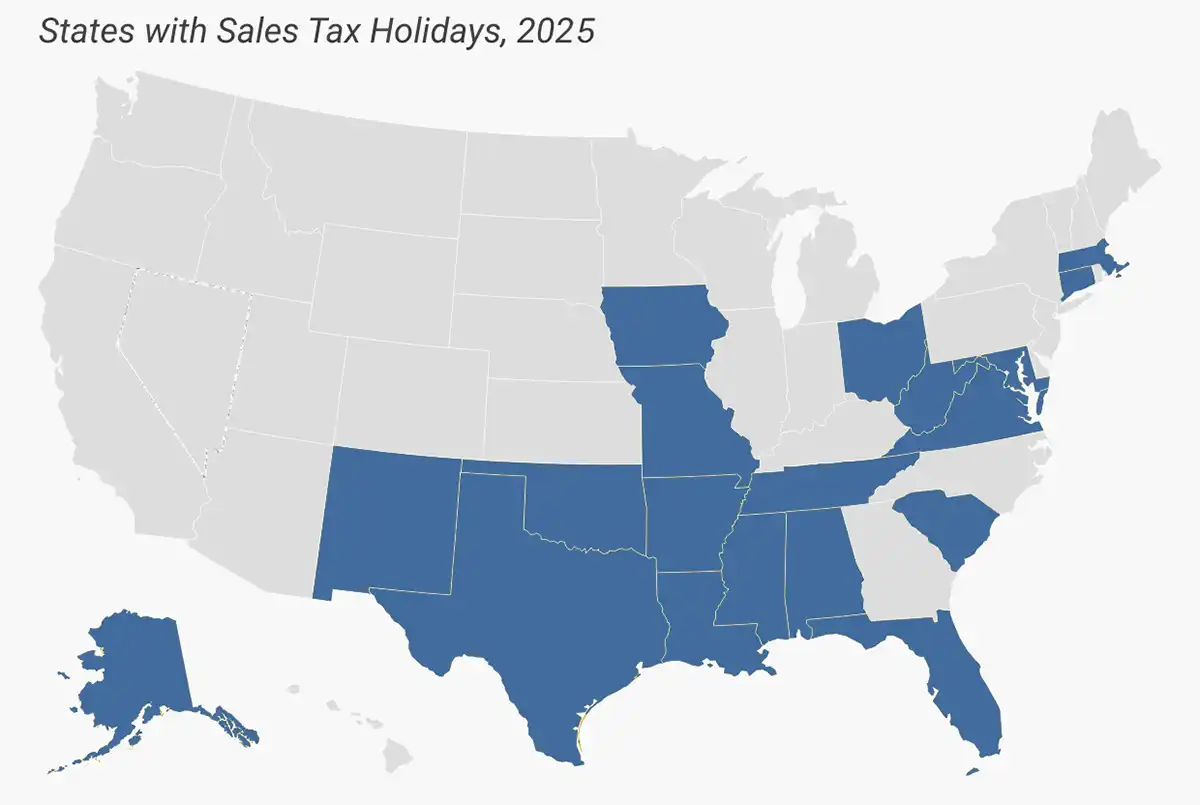

State Participation Trends

The number of states offering sales tax holidays has fluctuated over time. From a peak of 19 states in 2010, participation has stabilized around 17-18 states in recent years. Some states have discontinued their holidays due to budget concerns, while others have expanded their programs with new categories and longer durations.

2025 State-by-State Sales Tax Holiday Guide

| State | Holiday Type | Dates (2025) | Eligible Items | Price Restrictions |

|---|---|---|---|---|

| Alabama | Back-to-School | July 18-20 | Clothing, computers, school supplies, books | Clothing: $100 Computers: $750 School supplies: $50 Books: $30 |

| Alabama | Severe Weather Preparedness | February 21-23 | Generators, emergency supplies | Generators: $1,000 Supplies: $60 |

| Arkansas | Back-to-School | August 2-3 | Clothing, school supplies, electronic devices | Clothing: $100 Accessories: $50 No limit on other items |

| Connecticut | Back-to-School | August 16-22 | Clothing, footwear | Up to $300 per item |

| Florida | Disaster Preparedness | June 7-20 August 23-September 5 |

Hurricane supplies, generators | Various: $10 to $3,000 |

| Florida | Back-to-School | July 28-August 10 | School supplies, clothing, computers | School supplies: $50 Clothing: $100 Computers: $1,500 |

| Florida | Freedom Month | July 1-31 | Admissions to performances, recreational supplies | $25-$50 |

| Florida | Tool Time | August 31-September 6 | Tools and equipment | Various |

| Iowa | Back-to-School | August 1-2 | Clothing, footwear | Less than $100 |

| Maryland | Back-to-School | August 9-15 | Clothing, footwear, backpacks | Clothing: $100 Backpacks: first $40 |

| Maryland | Energy Savings | February 14-16 | Energy Star products, solar water heaters | No restrictions |

| Massachusetts | General Sales | TBA (August) | Most personal tangible property | $2,500 or less |

| Mississippi | Back-to-School | July 11-13 | Clothing, footwear, school supplies | Less than $100 |

| Mississippi | Second Amendment | TBA (August/September) | Firearms, ammunition, hunting supplies | No restrictions |

| Missouri | Back-to-School | August 1-3 | Clothing, computers, school supplies | Clothing: $100 Computers: $1,500 Software: $350 Supplies: $50 |

| Missouri | Energy Star | April 19-25 | Energy Star appliances | $1,500 or less |

| New Mexico | Back-to-School | August 1-3 | Clothing, school supplies, computers | Clothing: $100 Computers: $1,000 Computer equip: $500 Supplies: $30 |

| Ohio | Back-to-School | August 1-3 | Most tangible personal property | Less than $500 |

| Oklahoma | Back-to-School | August 1-3 | Clothing, footwear | Less than $100 |

| South Carolina | Back-to-School | August 1-3 | Clothing, school supplies, computers, bed/bath items | No restrictions |

| Tennessee | Back-to-School | July 25-27 | Clothing, school supplies, computers | Clothing: $100 Computers: $1,500 Supplies: $100 |

| Texas | Back-to-School | August 8-10 | Clothing, footwear, school supplies, backpacks | Less than $100 |

| Texas | Energy Star | May 24-26 | Energy Star appliances | Air conditioners: $6,000 Refrigerators: $2,000 Other items: no limit |

| Texas | Emergency Prep | April 26-28 | Emergency supplies, generators | Generators: $3,000 Emergency devices: $300 Supplies: $75 |

| Texas | Water-Efficient | May 24-26 | Water-conserving products | No restrictions |

| Virginia | Combined | August 1-3 | School supplies, clothing, emergency prep items, Energy Star products | Various restrictions by category |

| West Virginia | Back-to-School | August 1-4 | Clothing, school supplies, computers, sports equipment | Clothing: $125 Computers: $500 School supplies: $50 Sports equip: $150 |

Note about Local Participation

In some states, local governments can choose whether to participate in the sales tax holiday. Always check with your local retailers or tax authority to confirm if both state and local sales taxes will be waived during the holiday period.

Most Popular Sales Tax Holiday Categories

Tips for Maximizing Your Tax Holiday Savings

Before the Holiday

- Research your state's exact dates and exemption rules

- Create a shopping list of qualifying items you need

- Check price thresholds for different categories

- Sign up for retailer emails for additional promotions

- Compare prices ahead of time to ensure retailers haven't raised prices

During the Holiday

- Shop early for the best selection of items

- Keep receipts and verify tax wasn't charged

- Combine manufacturer coupons with tax savings

- Consider buying online if your state allows it

- Split larger purchases to stay under price thresholds

Common Tax Holiday Misconceptions

Misconception: Everything is tax-free

Reality: Only specific categories of items qualify, and many have price restrictions. Always check your state's guidelines for the exact items covered.

Misconception: You can use rain checks later

Reality: Most states require items to be purchased during the actual holiday period. Rain checks for later purchases typically don't qualify for the exemption.

Misconception: Layaway purchases always qualify

Reality: Policies on layaway vary by state. Some require final payment during the holiday, while others count the initial deposit date.

Misconception: Online purchases never qualify

Reality: Many states allow tax-free online purchases as long as the order is placed and paid for during the holiday period, even if delivery occurs later.

Impact on Retailers

While sales tax holidays create shopping opportunities for consumers, they present both benefits and challenges for retailers:

Benefits for Retailers

- Increased foot traffic during typically slower shopping periods

- Opportunity to attract new customers

- Potential for additional sales of non-exempt items

- Marketing hook for promotional campaigns

Challenges for Retailers

- Reprogramming point-of-sale systems for temporary exemptions

- Training staff on complex exemption rules

- Increased staffing needs during holiday periods

- Inventory management challenges for high-demand items

Data based on 2024 survey of 500 small and midsize US retailers

Retailer Compliance Requirements

In most states, retailer participation in sales tax holidays is mandatory. Businesses must:

- Accurately identify which items qualify for exemption

- Properly program their point-of-sale systems

- Train staff on the specific rules for their state

- Keep detailed records of exempt sales

- Handle returns and exchanges according to state guidelines

Debates Around Sales Tax Holidays

Proponents Argue

- Provide tangible tax relief for families, especially for back-to-school purchases

- Stimulate local economic activity during specific periods

- Help retailers increase sales and customer traffic

- Raise awareness about emergency preparedness and energy efficiency

- Create goodwill between state governments and taxpayers

Critics Argue

- Primarily shift the timing of purchases rather than generate new sales

- Create compliance costs and complexity for retailers

- Reduce state tax revenue that could fund essential services

- May not significantly benefit low-income families

- Some retailers raise prices during holidays, reducing consumer benefits

Future Trends in Sales Tax Holidays

Sales tax holidays continue to evolve as states experiment with different approaches. Here are some emerging trends to watch:

Expanded Categories

States are adding new product categories to existing holidays. Florida's "Freedom Month" and "Tool Time" holidays represent this diversification trend.

Extended Durations

Some states are extending holidays from traditional weekends to full weeks or even months, providing more opportunities for consumers to benefit.

Digital Integration

Improved point-of-sale technology is making it easier for retailers to implement tax holidays for both in-store and online purchases.

Calculate Your Potential Savings

Use our free Sales Tax Holiday Calculator to estimate how much you can save during your state's tax-free periods.

Our calculator allows you to input your planned purchases by category, apply your state's specific tax rates and exemption rules, and see your potential savings instantly.

Conclusion

Sales tax holidays provide tangible benefits for consumers while creating both opportunities and challenges for retailers. By understanding the specific rules in your state and planning accordingly, you can maximize your savings during these tax-free periods.

For the most current information on sales tax holidays in your state, including exact dates, eligible items, and price restrictions, consult your state's department of revenue website or use our US State Sales Tax Holiday Calculator.

Whether you're shopping for back-to-school supplies, preparing for severe weather, or looking to purchase energy-efficient appliances, sales tax holidays offer an opportunity to save money while supporting local businesses in your community.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.