Understanding Payroll in 2025: More Than Just a Paycheck

The landscape of business operations is constantly shifting, driven by technological advancements, evolving regulatory environments, and changing workforce expectations. Within this dynamic context, payroll—the system by which organizations compensate their employees—has transformed significantly. Once viewed primarily as a routine back-office task focused on check distribution, payroll in 2025 has evolved into a complex, tech-powered engine critical for compliance, employee satisfaction, and strategic business decisions. It sits at the intersection of finance, human resources, and legal compliance, demanding accuracy, timeliness, and strategic oversight. This guide provides a detailed exploration of payroll in 2025, covering its core functions, essential purpose, prevailing trends, operational processes, key components, management methods, compliance requirements, and the undeniable importance of getting it right.

What is Payroll? Defining the Core Function

At its heart, payroll refers to the total compensation a business must pay its employees for work performed over a defined period or on a specific date. This fundamental process involves several interconnected activities. Primarily, it includes calculating the correct wages or salaries for each employee based on hours worked, agreed-upon rates, or performance metrics.

However, the scope extends far beyond simple calculation. Effective payroll management necessitates:

- Meticulous tracking of employee work hours, including overtime, paid time off (PTO), and sick leave.

- Managing a complex web of deductions, encompassing mandatory tax withholdings (federal, state, local), FICA contributions (Social Security & Medicare), and voluntary deductions (health insurance, 401(k)s, etc.).

- Ensuring timely distribution of net pay (gross pay minus all deductions) via methods like direct deposit or checks.

- Strict adherence to numerous federal, state, and local laws governing wage payment, tax remittance, and reporting.

- Maintaining accurate and secure payroll records for compliance, audits, and financial transparency.

The term "payroll" can also refer to the list of employees eligible for payment and their compensation, or the department/firm managing the process. Financially, payroll is a major operating expense, often tax-deductible, impacting profitability and cash flow. Its evolution integrates compliance, benefits, data security, and employee experience, making it central to business operations.

The Essential Purpose of Payroll for Modern Businesses

Accurate and timely payroll execution serves multiple critical purposes for businesses in 2025, extending far beyond simply paying wages.

- Fulfilling Obligations & Motivation: It meets the fundamental requirement of compensating employees, the primary motivator for work. Failure severely impacts morale and retention.

- Compliance Criticality: Businesses must navigate complex laws (FLSA, FICA, FUTA, state/local regulations) regarding wages, taxes, and reporting. Non-compliance leads to substantial penalties, fines, and legal risks.

- Employee Morale & Retention: Reliable, accurate pay builds trust and loyalty, reducing costly turnover. Errors quickly erode confidence.

- Financial Management & Strategy: Payroll data offers insights into labor costs, aiding budgeting, staffing, and profitability analysis. Accurate records are vital for transparency and audits.

- Company Reputation: Reliable payroll signals stability and ethical operation, enhancing the employer brand. Errors can damage reputation internally and externally.

- Employee Financial Well-being: Consistent pay provides financial stability, reducing stress and improving focus.

The Evolution: From Back Office Task to Strategic Asset

Historically, payroll was seen as an administrative chore. In 2025, it's transforming into a strategic asset, powered by technology and integrated deeply into business operations.

Key drivers of this evolution include:

- Automation (AI, ML, RPA): Technologies automate repetitive tasks like data entry, calculations, and compliance checks, freeing professionals for strategic work.

- Strategic Partnership: Payroll teams now leverage data to provide insights on labor costs, compensation trends, and compliance risks, informing strategic decisions.

- Integration with HCM: Payroll is becoming part of broader Human Capital Management systems, enhancing data flow and consistency.

- Focus on Employee Experience: User-friendly systems with self-service and flexible pay options (like Earned Wage Access - EWA) are crucial touchpoints.

This shift requires viewing payroll not just as necessary, but as a tech-enabled function driving compliance, satisfaction, and business intelligence.

Key Payroll Trends Shaping 2025

Several powerful trends are reshaping payroll in 2025. Small businesses should be aware of these to stay competitive and compliant.

The Rise of Automation: AI and RPA in Payroll

Automation via Artificial Intelligence (AI) and Robotic Process Automation (RPA) is becoming practical and widespread, especially in cloud-based platforms.

- AI Applications: Automated data entry/validation, complex calculations, tax compliance checks, fraud detection, predictive analytics, and AI chatbots for employee queries.

- RPA Applications: Automating simpler, rule-based tasks like bulk record updates or routine calculations.

- Impact: Frees payroll professionals for strategic analysis, exception management, and complex compliance, augmenting human capabilities. Requires focus on responsible AI integration.

Empowering Employees: Self-Service and On-Demand Pay

Employee-centric features are in high demand, focusing on experience and financial well-being.

- Employee Self-Service (ESS): Standard portals allowing 24/7 access to pay stubs, tax forms (W-2), personal detail updates, direct deposit management, time tracking, and PTO balances. Reduces administrative load.

- Earned Wage Access (EWA) / On-Demand Pay: Allows employees to access earned wages before payday, enhancing financial flexibility and potentially reducing reliance on high-cost loans. Seen as a retention tool.

- General Flexibility: Tools enabling early salary payments, faster reimbursements, and less rigid payroll schedules.

Globalization and Complexity: Managing International Payroll

Global workforces add complexity due to diverse laws, taxes, currencies, and data privacy rules.

- Unified Platforms: Shift towards cloud-based global payroll platforms for centralized oversight and streamlined compliance.

- Vendor Partnerships: Emphasis on reliable partners with deep local expertise, moving beyond simple vendor relationships.

- Integration-First Approach: Preference for core payroll platforms that integrate seamlessly with other specialized tools (like local providers or EORs) for flexibility and best-in-class solutions.

Data Security and Privacy: A Top Priority

Protecting sensitive payroll data (SSNs, bank info, salaries) is paramount due to cyber threats and regulatory requirements.

- Increased Investment: Many businesses plan to boost data safeguard investments in 2025.

- Technical Defenses: Strong encryption, multi-factor authentication (MFA), secure storage (VPCs), and AI for fraud detection.

- Regulatory Compliance: Adherence to GDPR and other data privacy laws requires robust processes and technology. Access must be strictly controlled.

- Human Element: Cybersecurity training for staff to recognize phishing and social engineering attempts is critical. Secure record retention and disposal policies are essential.

Compliance Under Pressure: Navigating Regulatory Changes

Staying compliant with dynamic federal, state, and local laws remains a critical challenge. Key areas include:

- FLSA: Minimum wage, overtime (often 1.5x pay over 40 hrs/week for non-exempt), recordkeeping. Monitoring fluctuating overtime salary thresholds is crucial (though subject to legal challenges).

- Worker Classification: Correctly distinguishing between employees vs. independent contractors, and exempt vs. non-exempt status, based on DOL and IRS tests. Misclassification is a costly error.

- FICA/FUTA/SUTA: Mandatory Social Security, Medicare, and unemployment taxes (both employer and employee portions where applicable).

- State/Local Laws: Expanding paid family/medical leave (PFML) programs, varying income tax withholding rules, pay stub requirements.

- Remote Work: Complexities regarding tax obligations for employees working across state lines.

Modern payroll technology is vital for automating updates, calculations, and reporting to aid compliance.

Pay Transparency and Equity: Meeting New Expectations

Increasing legislation and workforce expectations demand more openness about pay structures and ensuring fairness.

- Pay Transparency Laws: Many states (e.g., CO, CA) and the EU require salary range disclosure in job postings and providing pay scale info to employees.

- Clear Salary Structures: Businesses need well-defined salary bands based on market data, skills, experience, and location.

- Pay Equity: Ensuring fair pay regardless of gender, race, etc., as mandated by the Equal Pay Act and Title VII. Payroll data is key for audits to identify and fix unjustified wage gaps. AI tools can assist analysis.

Holistic HR: Integrating Payroll Systems

Moving away from standalone solutions, payroll is increasingly integrated with HRIS/HCM platforms.

- Benefits: Reduces redundant data entry, minimizes errors, creates a single source of truth for employee data, streamlines reporting, and improves efficiency.

- Employee Experience: Unified portals for payroll, benefits, time tracking enhance usability and satisfaction.

- Integration Focus: Rise of platforms with strong APIs to connect smoothly with other best-of-breed systems (accounting, time tracking, etc.).

Emerging Payment Methods: Exploring Options

While direct deposit dominates, flexibility is growing.

- Cryptocurrency: Niche adoption allowing salary portions in Bitcoin, citing speed and potential cost savings, but facing volatility and regulatory hurdles.

- Mobile Payments & Pay Cards: Integration of PayPal/Venmo (esp. for gig workers) and growing use of pay cards for unbanked employees.

- Digital Wallets: Emerging integration into some platforms.

- Core Idea: Offering more choice in how and when employees are paid aligns with personalization trends.

The End-to-End Payroll Process Explained

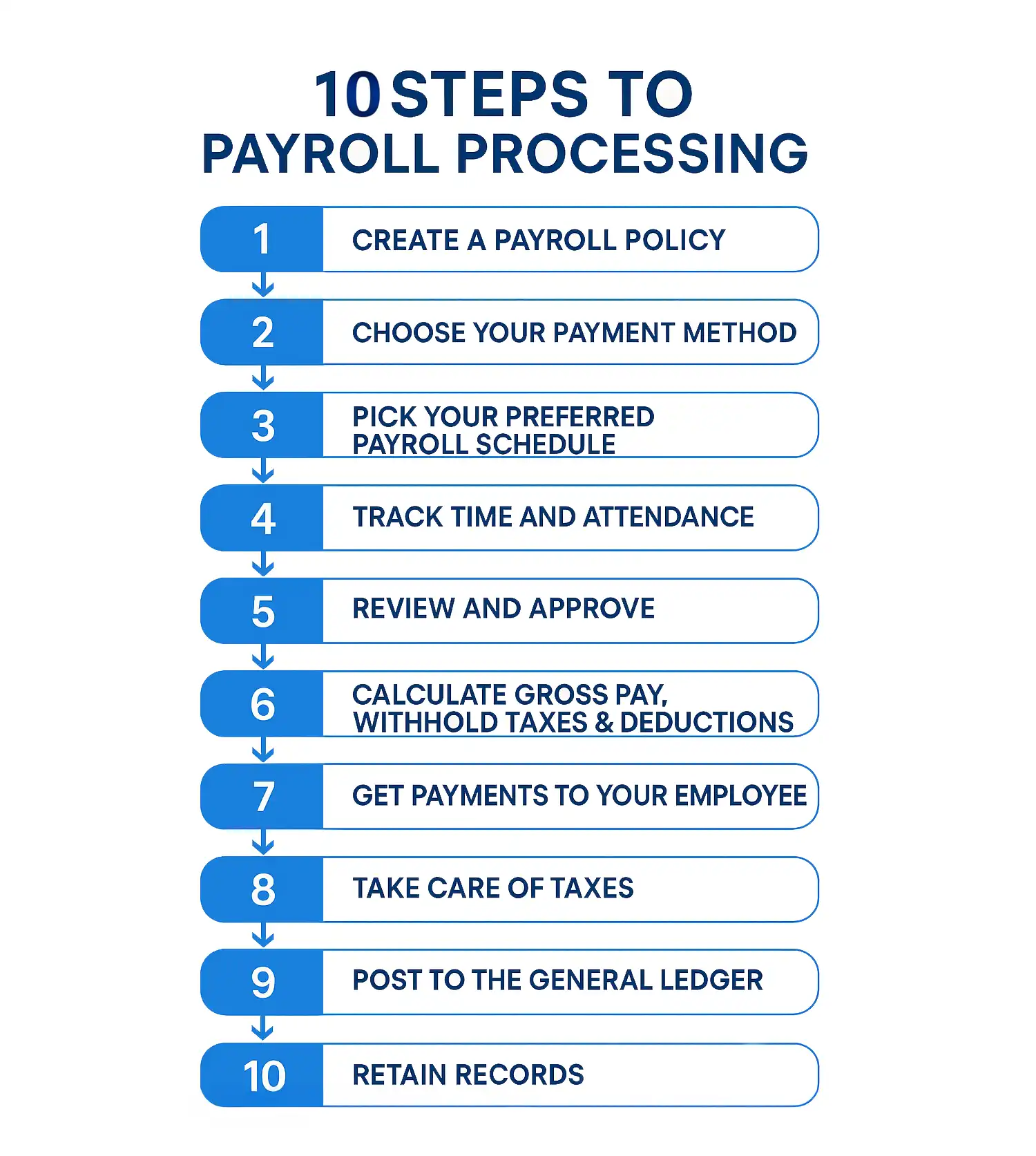

Processing payroll involves sequential steps, crucial for accuracy, compliance, and timely payments.

Setting the Stage: Pre-Payroll Setup and Policies

Foundation is key. Before the first payroll run:

- Obtain Tax IDs: Federal EIN, state/local tax IDs, register for EFTPS for federal tax payments.

- Establish Payroll Policies: Define pay frequency, pay dates, payment methods, time tracking procedures, overtime rules, deduction handling, recordkeeping guidelines. Ensure compliance with FLSA and state laws.

- Choose Processing Method: Manual (risky, only for very small/simple), In-house Software (e.g., TimeTrex), Outsourced Service (PSP or PEO).

- Collect Employee Paperwork: Form W-4 (federal tax withholding), state W-4s, Form I-9 (eligibility verification), direct deposit authorization, benefit deduction authorizations. Collect W-9 for independent contractors.

- Classify Workers Correctly: Determine Employee vs. Independent Contractor status (using IRS/DOL tests) and Exempt vs. Non-Exempt status (based on salary and duties tests). Misclassification is a major risk.

Step 1: Gathering Employee Data and Tracking Time

The recurring cycle starts with accurate data collection for the pay period.

- Track Hours (Non-Exempt): Record regular hours, overtime, breaks, PTO (vacation, sick, holiday).

- Time Tracking Methods: Manual timesheets (error-prone), physical time clocks, or preferably, automated time & attendance software integrated with payroll. Mobile clock-in/out with geofencing adds accuracy for remote workers.

- Validate Data: Manager review and approval of timesheets are crucial control points. Correct errors promptly.

- Gather Other Changes: Updates to salary, bonuses/commissions, benefit deductions, new hires/terminations, address/bank details, W-4 changes.

Step 2: Calculating Gross Pay

Calculate total earnings before deductions.

- Hourly Employees: (Total Hours Worked × Hourly Rate) + (Overtime Hours × Overtime Rate [typically 1.5x regular rate]). State laws may differ.

- Salaried Employees: (Annual Salary ÷ Number of Pay Periods per Year). Remember: Salaried non-exempt employees are still eligible for overtime pay if they work over 40 hours (or state threshold).

- Include Other Compensation: Bonuses, commissions, tips, PTO pay, allowances, certain fringe benefits, retroactive pay. Be mindful that non-discretionary bonuses often factor into the overtime rate calculation.

Payroll software automates these complex calculations, minimizing errors.

Step 3: Handling Deductions - Pre-Tax vs. Post-Tax

Subtract various deductions from gross pay. Understanding the timing relative to taxes is critical.

- Pre-Tax Deductions: Subtracted *before* income taxes are calculated, reducing taxable income. Examples: Traditional 401(k) contributions, qualified health/dental/vision premiums (Sec 125 plan), HSA/FSA contributions. Subject to annual IRS limits.

- Post-Tax Deductions: Subtracted *after* taxes are calculated; do not reduce taxable income. Examples: Roth 401(k) contributions, wage garnishments (mandatory), union dues, charitable donations, supplemental insurance premiums.

Common Payroll Deductions (2025)

| Deduction Type | Typical Tax Treatment | Impact on Taxable Income | Common Examples |

|---|---|---|---|

| Health Insurance (Sec 125 Plan) | Pre-Tax | Reduces | Medical, Dental, Vision Premiums |

| Traditional 401(k)/403(b) | Pre-Tax | Reduces | Employee Retirement Contributions |

| Health Savings Account (HSA) | Pre-Tax | Reduces | Contributions for HDHP participants |

| Flexible Spending Account (FSA) | Pre-Tax | Reduces | Medical or Dependent Care Expenses |

| Group Term Life Insurance (<$50k) | Pre-Tax | Reduces | Employer-sponsored life insurance premiums |

| Commuter Benefits (Qualified) | Pre-Tax | Reduces | Transit passes, qualified parking |

| Roth 401(k)/IRA Contributions | Post-Tax | No Impact | Employee Retirement Contributions |

| Wage Garnishments | Post-Tax | No Impact | Child Support, Tax Levies, Creditor Debts (Mandatory) |

| Union Dues | Post-Tax | No Impact | Membership Fees |

| Charitable Donations | Post-Tax | No Impact | Employee-elected contributions via payroll |

| Supplemental Life/Disability Ins | Post-Tax (Often) | No Impact | Premiums for additional coverage |

Step 4: Calculating and Withholding Payroll Taxes

A mandatory and complex part of payroll, requiring accurate calculation of employee withholdings and employer liabilities.

- Federal Income Tax (FIT): Withheld based on employee's W-4 info, taxable wages, and IRS tables (Pub 15-T).

- FICA Taxes (Social Security & Medicare): Shared responsibility. Employee portion withheld, employer pays matching amount.

- 2025 Social Security: 6.2% employee + 6.2% employer on wages up to $176,100.

- 2025 Medicare: 1.45% employee + 1.45% employer on all wages.

- Additional Medicare Tax: 0.9% withheld on employee wages > $200,000 (single filer); no employer match.

- Federal Unemployment Tax (FUTA): Employer-paid tax. Nominal rate 6.0% on first $7,000 annual wages per employee, but typically reduced to 0.6% ($42/employee/year max) with state unemployment tax credits. Rate can be higher in credit reduction states.

- State Unemployment Tax (SUTA/SUI): Employer-paid (except AK, NJ, PA). Rates and wage bases vary significantly by state, often experience-rated.

- State/Local Income Taxes: Withheld where applicable, based on work/residence location rules. Requirements vary widely.

Key 2025 US Federal Payroll Tax Rates & Limits

| Tax Type / Contribution | Employee Rate/Limit | Employer Rate/Limit | 2025 Wage Base / Contribution Limit |

|---|---|---|---|

| Social Security (FICA) | 6.2% | 6.2% | $176,100 |

| Medicare (FICA) | 1.45% | 1.45% | No Limit |

| Additional Medicare Tax | 0.9% (on wages >$200k single) | None | Applies above threshold |

| FUTA | None | 0.6% - 6.0%* | $7,000 |

| 401(k) Employee Deferral | $23,500 | N/A | $23,500 |

| 401(k) Catch-up (Age 50+) | +$7,500 | N/A | $31,000 (Total) |

| 401(k) Catch-up (Age 60-63) | +$11,250** | N/A | $34,750 (Total)** |

| HSA Contribution (Self-Only) | $4,300 | N/A | $4,300 |

| HSA Contribution (Family) | $8,550 | N/A | $8,550 |

| HSA Catch-up (Age 55+) | +$1,000 | N/A | +$1,000 |

| Health FSA Contribution | $3,300 | N/A | $3,300 |

| Health FSA Carryover Limit | $660 | N/A | $660 |

*Effective FUTA rate is typically 0.6% after state unemployment tax credits, but higher in credit reduction states.

**Higher catch-up for ages 60-63 effective 2025 per SECURE 2.0 Act, if plan allows and system capabilities exist. Check plan details.

Step 5: Determining Net Pay

The final "take-home" amount after all calculations.

Formula: Net Pay = Gross Pay - Pre-Tax Deductions - Payroll Taxes - Post-Tax Deductions

Accuracy here depends entirely on the precision of previous steps. This is the amount disbursed to the employee.

Step 6: Approving and Distributing Payments

Final checks and timely payment distribution.

- Payroll Approval: Thorough review and formal sign-off by an authorized manager/owner before payments are issued. Essential quality control. Many systems have approval workflows.

- Payment Distribution: Disburse net pay on time via agreed methods. Direct deposit is most common. Other options: paper checks, pay cards. State laws may dictate required options.

- Provide Pay Stubs: Deliver itemized wage statements (electronically or printed) as required by most states. Stubs detail gross pay, deductions, net pay, hours, rates, etc., ensuring transparency. ESS portals are common for delivery.

Step 7: Reporting, Remitting Taxes, and Recordkeeping

Ongoing compliance tasks after payments are made.

- Tax Deposits (Remittance): Electronically remit withheld employee taxes (FIT, FICA) and employer taxes (FICA match, FUTA) to agencies via EFTPS (federal) on required schedule (monthly or semi-weekly). State/local deposit rules vary. Timeliness avoids penalties.

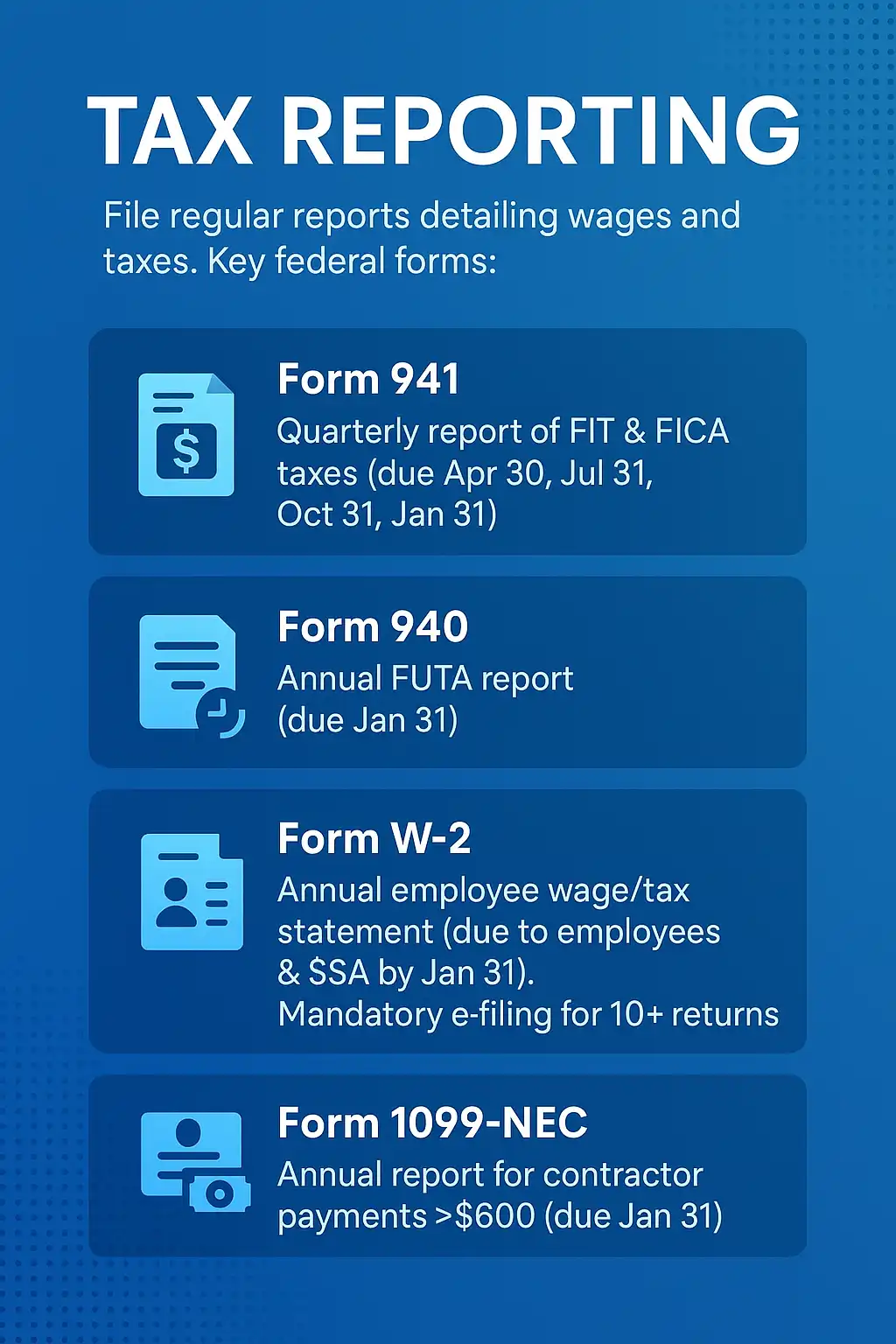

- Tax Reporting: File regular reports detailing wages and taxes. Key federal forms:

- Form 941: Quarterly report of FIT & FICA taxes (due Apr 30, Jul 31, Oct 31, Jan 31).

- Form 940: Annual FUTA report (due Jan 31).

- Form W-2: Annual employee wage/tax statement (due to employees & SSA by Jan 31). Mandatory e-filing for 10+ returns.

- Form 1099-NEC: Annual report for contractor payments >$600 (due Jan 31).

- Recordkeeping: Maintain accurate, organized, secure payroll records. Required by FLSA (3 yrs payroll, 2 yrs time records) and IRS (4 yrs tax records). Adhere to the longest applicable state requirement. Records must be accessible for audits (often within 72 hrs) and secured to protect data privacy. Regular backups are crucial.

- General Ledger Posting: Record payroll transactions accurately in the accounting system. Integration helps.

Deconstructing the Paycheck: Key Components

Understanding the elements on a pay stub is vital for both employers and employees.

Gross Pay vs. Net Pay: Understanding the Difference

- Gross Pay: Total earnings *before* any deductions (base pay + overtime + bonuses, etc.). The starting point.

- Net Pay: "Take-home pay" *after* all mandatory and voluntary deductions are subtracted. The amount received by the employee.

The pay stub itemizes the deductions that bridge the gap between gross and net pay.

Elements of Gross Pay: Salary, Hourly Wages, Bonuses, and More

Gross pay is the sum of various compensation types earned:

- Base Pay: Fixed salary or hourly rate.

- Overtime Pay: Premium pay (usually 1.5x) for non-exempt hours over threshold.

- Bonuses: Performance, sign-on, etc. (Nondiscretionary bonuses affect overtime rate).

- Commissions: Sales-based earnings.

- Tips: Reported gratuities.

- PTO Compensation: Pay for vacation, sick time, holidays.

- Allowances: Payments for specific purposes (e.g., car, meals).

- Other: Retroactive pay, certain fringe benefits.

Understanding Payroll Deductions (Mandatory vs. Voluntary)

Amounts subtracted from gross pay:

- Mandatory Deductions: Required by law/court order. Cannot be opted out of. Examples: Federal/State/Local Income Tax, FICA, Garnishments, SUI/SDI (where applicable).

- Voluntary Deductions: Employee-elected with authorization. Examples: Health/Dental/Vision Premiums, 401(k)/Retirement Contributions, Life/Disability Insurance, HSA/FSA, Union Dues, Charitable Donations.

Sources & Further Reading

This article synthesizes information from various reputable sources on payroll practices, compliance, and trends for 2025. Key sources include government agencies and industry leaders. Tax rates and limits reflect known 2025 figures or official projections as of April 22, 2025, but are subject to change. Always consult qualified professionals for specific advice.

- IRS Publication 15 (Circular E), Employer's Tax Guide

- IRS Publication 15-T, Federal Income Tax Withholding Methods

- U.S. Department of Labor - Wages and the Fair Labor Standards Act (FLSA)

- DOL Fact Sheet #21: Recordkeeping Requirements under the FLSA

- Social Security Administration - Contribution and Benefit Base

- IRS Cost-of-Living Adjustments for Retirement Plan Contributions

- IRS - Independent Contractor vs. Employee Classification

- Investopedia - What Is Payroll?

- ADP - What is payroll processing?

- Paychex - Payroll Industry Trends

- Paycor - Payroll Compliance: What You Need to Know

- Rippling - How to Process Payroll: 13 Steps & Tips for Efficiency

- Multiplier - Payroll trends 2025

- HRtech247 - Global Payroll in 2025

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.