Florida Sales Tax Guide (2025)

A comprehensive overview of Florida's sales tax structure, rates, exemptions, and filing requirements

Table of Contents

Overview of Florida Sales Tax

Quick Facts:

- Florida's state sales tax rate is 6%

- Counties can add discretionary sales surtaxes of up to 2%

- Florida does not have a state income tax, making sales tax a crucial revenue source

- Certain items like groceries and prescription medications are exempt from sales tax

- Florida offers several sales tax holidays throughout the year

Florida's sales tax system is a significant source of revenue for the state, especially since Florida does not levy a personal income tax. The tax applies to most sales of tangible personal property and some services within the state.

Sales tax in Florida is comprised of two components:

- State Sales Tax: A flat 6% rate applied statewide on most purchases

- Discretionary Sales Surtax: Additional local taxes imposed by individual counties, ranging from 0% to 2%

Understanding Florida's sales tax system is essential for both businesses and consumers to ensure proper compliance and to avoid unexpected costs when making purchases within the state.

Florida State Sales Tax Rate

Florida imposes a general state sales tax rate of 6% on most transactions. However, there are several notable exceptions:

| Transaction Type | Tax Rate |

|---|---|

| General Sales and Use | 6% |

| Retail sales of new mobile homes | 3% |

| Amusement machine receipts | 4% |

| Rental, lease, or license of commercial real property | 2% |

| Electricity | 6.95% |

How Florida's Sales Tax Compares Nationally

Florida's state-level sales tax rate of 6% places it in the middle range compared to other states. When combined with local surtaxes, Florida's total sales tax rates can range from 6% to 8%, which is still relatively competitive nationally.

Important Note

Florida state sales tax is calculated on each taxable transaction. When multiple taxable items are included on a single invoice, the tax can be calculated on either the combined total of taxable items or on each individual taxable item, with the total tax rounded to the nearest cent.

County Sales Tax Rates

In addition to the state sales tax, many Florida counties impose a local option discretionary sales surtax (often referred to as a "county tax"). These local taxes range from 0% to 2% depending on the county.

Important: The county surtax applies to the first $5,000 of the sales amount on any item of tangible personal property. Amounts above $5,000 are only subject to the state's 6% sales tax rate.

| County | County Surtax | Total Sales Tax |

|---|---|---|

| Alachua | 1.5% | 7.5% |

| Baker | 1% | 7% |

| Bay | 1% | 7% |

| Bradford | 1% | 7% |

| Brevard | 1% | 7% |

| Broward | 1% | 7% |

| Calhoun | 1.5% | 7.5% |

| Charlotte | 1% | 7% |

| Citrus | 0% | 6% |

| Clay | 1.5% | 7.5% |

| Collier | 0% | 6% |

| Columbia | 1.5% | 7.5% |

Note: The table above shows a selection of Florida counties. For the complete list, please refer to the Florida Department of Revenue or use our calculator below.

Florida Sales Tax Map by County

| City | County | Total Tax Rate |

|---|---|---|

| Jacksonville | Duval | 7.500% |

| Miami | Miami-Dade | 7.000% |

| Tampa | Hillsborough | 8.500% |

| Orlando | Orange | 6.500% |

| St. Petersburg | Pinellas | 7.000% |

| Hialeah | Miami-Dade | 7.000% |

| Port St. Lucie | St. Lucie | 7.000% |

| Tallahassee | Leon | 7.500% |

| Cape Coral | Lee | 6.500% |

| Fort Lauderdale | Broward | 7.000% |

| Pembroke Pines | Broward | 7.000% |

| Hollywood | Broward | 7.000% |

| Miramar | Broward | 7.000% |

| Gainesville | Alachua | 7.000% |

| Coral Springs | Broward | 7.000% |

| Clearwater | Pinellas | 7.000% |

| Palm Bay | Brevard | 7.000% |

| Lakeland | Polk | 7.000% |

| Pompano Beach | Broward | 7.000% |

| West Palm Beach | Palm Beach | 7.000% |

| Miami Gardens | Miami-Dade | 7.000% |

| Davie | Broward | 7.000% |

| Boca Raton | Palm Beach | 7.000% |

| Sunrise | Broward | 7.000% |

| Plantation | Broward | 7.000% |

| Deltona | Volusia | 6.500% |

| Palm Coast | Flagler | 7.000% |

| Miami Beach | Miami-Dade | 7.000% |

| Fort Myers | Lee | 6.500% |

| Largo | Pinellas | 7.000% |

Location Matters

Sales tax is generally collected based on the county where the goods are delivered or services are provided. For in-store purchases, this is the location of the store. For shipped items, it's typically the delivery address.

Sales Tax Exemptions

Florida provides numerous sales tax exemptions for certain goods and services. Understanding these exemptions can help consumers and businesses save money on their purchases.

Common Tax-Exempt Items

Groceries

Food products for human consumption (excluding prepared foods, such as restaurant meals)

Medications

Prescription drugs and certain non-prescription medications

Residential Rent

Long-term residential rentals (more than 6 months)

Publications

Newspapers and certain magazines

Farm Products

Certain agricultural products and equipment

Medical Devices

Many medical products and mobility devices

Organization-Based Exemptions

Florida also provides sales tax exemptions for purchases made by certain types of organizations:

- Federal, state, and local government agencies

- Qualified non-profit organizations (501(c)(3) organizations)

- Schools and educational institutions

- Religious organizations

- Veterans' organizations

Exemption Certificates

Organizations seeking tax-exempt status must apply for a Consumer's Certificate of Exemption from the Florida Department of Revenue. This certificate must be presented to sellers at the time of purchase to qualify for tax exemption.

Business-Related Exemptions

Businesses may qualify for sales tax exemptions on certain types of purchases:

| Exemption Type | Description |

|---|---|

| Resale of Goods | Items purchased for resale with a valid Annual Resale Certificate |

| Manufacturing Equipment | Certain machinery and equipment used in manufacturing |

| Research & Development | Specific items used for research and development activities |

| Data Centers | Equipment purchased for qualifying data centers |

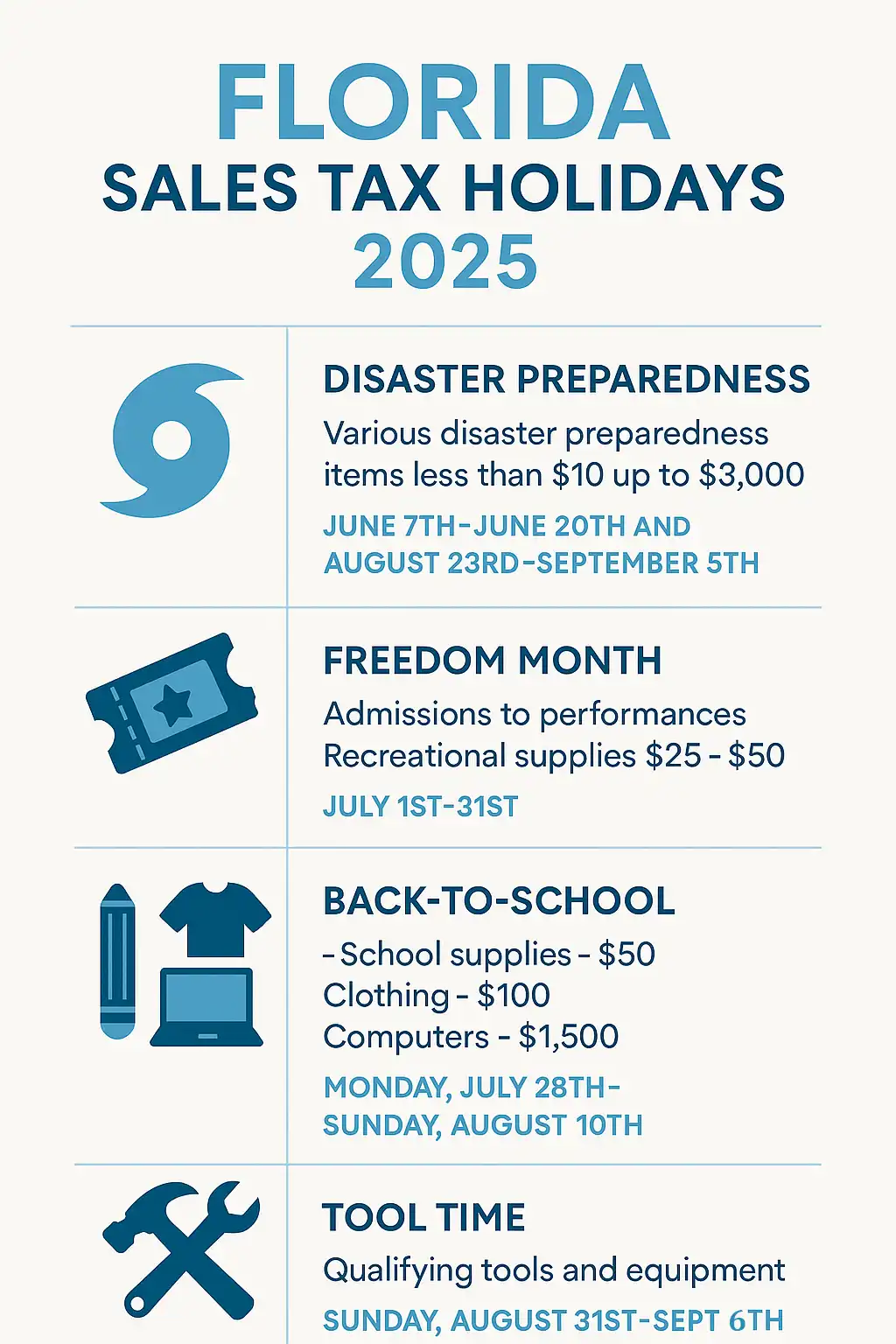

Sales Tax Holidays

Florida regularly implements sales tax holidays throughout the year, providing temporary periods where sales tax is not collected on specific categories of items. These holidays offer excellent opportunities for consumers to save money on their purchases.

Example of tax-exempt items during a Florida sales tax holiday

Proposed Sales Tax Holidays for 2025

| Holiday | Dates | Eligible Items |

|---|---|---|

| Back-to-School | 14 days (dates to be announced) | School supplies ($50 or less), Clothing ($100 or less), Computers ($1,500 or less) |

| Disaster Preparedness | Two 14-day periods (dates to be announced) | Hurricane supplies, generators, batteries, flashlights, and other emergency items |

| Freedom Summer | July 1-31, 2025 | Admissions to performances, recreational supplies ($25-$50) |

| Tool Time | 7 days (dates to be announced) | Qualifying tools and equipment for home improvement |

| Second Amendment | Between Memorial Day and July 4, 2025 | Firearms, ammunition, and hunting supplies |

Important Note

Sales tax holidays are subject to change based on legislative decisions. Always check with the Florida Department of Revenue for the most current information on tax holidays, dates, and eligible items.

Benefits of Sales Tax Holidays

Consumer Savings

Shoppers can save 6-8% on qualifying purchases during these periods

Retail Boost

Local businesses often see increased traffic and sales during tax holidays

Strategic Shopping

Consumers can plan major purchases around these dates to maximize savings

Filing and Payment

Businesses that sell taxable goods or services in Florida are required to register with the Florida Department of Revenue, collect sales tax from customers, and remit the tax to the state. Understanding the filing and payment requirements is essential for compliance.

Registration

Before making taxable sales in Florida, businesses must register with the Florida Department of Revenue to obtain a Certificate of Registration (Form DR-1). Registration can be completed online through the Department's website.

Who Needs to Register?

- Retailers selling taxable goods or services in Florida

- Out-of-state sellers with economic nexus in Florida (more than $100,000 in sales to Florida customers)

- Businesses that purchase taxable items without paying sales tax for use in Florida

- Businesses that rent or lease commercial real property or living/sleeping accommodations

Filing Frequency

The frequency of your sales tax filing is determined by the amount of sales tax you collect:

| Annual Sales Tax Collections | Filing Frequency |

|---|---|

| More than $1,000 | Monthly |

| $501 - $1,000 | Quarterly |

| $101 - $500 | Semi-annually |

| $100 or less | Annually |

Filing Methods

Online Filing

File and pay through the Florida Department of Revenue's online system

Mail Filing

Complete Form DR-15 and mail it with payment

Automated Filing

Use third-party services that automatically file sales tax returns

Filing Deadlines

Sales tax returns and payments are generally due on the 1st day of the month and late after the 20th day of the month following the reporting period. For example, January's sales tax is due February 1 and becomes late after February 20.

Penalties and Interest

Failing to file or pay sales tax on time can result in penalties and interest:

- Late Filing: If you file your return late, you will be charged a minimum penalty of $50, even if no tax is due. If tax is due, the penalty is 10% of the tax due per month, up to a maximum of 50%.

- Late Payment: The penalty for late payment is 10% of the tax due per month, up to a maximum of 50%.

- Interest: Interest is charged on late payments from the date the tax was due until the date it is paid. The interest rate is updated twice a year by the Florida Department of Revenue.

Florida Sales Tax Calculator

To simplify the process of calculating sales tax in Florida, TimeTrex offers a comprehensive Florida Sales Tax Calculator. This tool allows you to accurately determine the sales tax for any purchase based on your specific location in Florida.

Calculate Your Florida Sales Tax

Our calculator provides up-to-date tax rates for all counties and municipalities in Florida.

Use the CalculatorFeatures of Our Florida Sales Tax Calculator

Location-Specific

Select your county or city to get the exact sales tax rate for your area

Easy to Use

Simply enter your purchase amount and location to get instant results

Always Updated

Our rates are regularly updated to reflect the latest changes in tax laws

Mobile Friendly

Use on any device while shopping to calculate your final cost

How to Use the Calculator

- Visit the Florida Sales Tax Calculator on TimeTrex.com

- Select your county or city from the dropdown menu

- Enter the purchase amount in the provided field

- The calculator will instantly display:

- State sales tax amount

- County sales tax amount (if applicable)

- Total sales tax amount

- Final price including sales tax

Conclusion

Understanding Florida's sales tax system is essential for both businesses operating in the state and consumers making purchases. With a base state rate of 6% and county-specific surtaxes ranging from 0% to 2%, knowing the applicable rate for your location can help you accurately budget for purchases and business operations.

Businesses must ensure compliance with Florida's sales tax regulations by properly registering, collecting, and remitting sales tax. Failure to do so can result in penalties and interest charges. Meanwhile, consumers can benefit from knowing about sales tax exemptions and planning purchases during tax holidays to maximize savings.

For the most accurate and up-to-date sales tax calculations, we invite you to use the Florida Sales Tax Calculator provided by TimeTrex.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.