Guide to T4 Dental Benefit Codes in Canada

The Canadian government introduced new reporting requirements for employer-sponsored dental benefits starting with the 2023 tax year, marking a significant step toward enhancing the transparency of dental coverage in the workplace. These requirements mandate the use of specific codes on T4 slips to indicate the type and extent of dental benefits provided to employees.

T4 dental benefit codes play a crucial role in ensuring compliance with federal tax regulations and supporting the Canadian Dental Care Plan (CDCP). The CDCP aims to provide accessible dental care to Canadians who lack private insurance, relying on employer-reported data to identify gaps in coverage and allocate resources effectively.

This article serves as a comprehensive guide to T4 dental benefit codes, offering insights into their background, practical application, and broader implications. Whether you’re an employer navigating compliance requirements or an employee seeking to understand your dental benefits, this guide will equip you with the knowledge to make informed decisions.

Overview of T4 and T4A Reporting

Understanding the reporting requirements for dental benefits is essential for ensuring compliance with Canadian tax regulations. The introduction of specific reporting boxes on T4 and T4A slips is designed to capture critical information about employer- and payer-offered dental benefits. Here’s an in-depth look at the key components:

Key Reporting Boxes

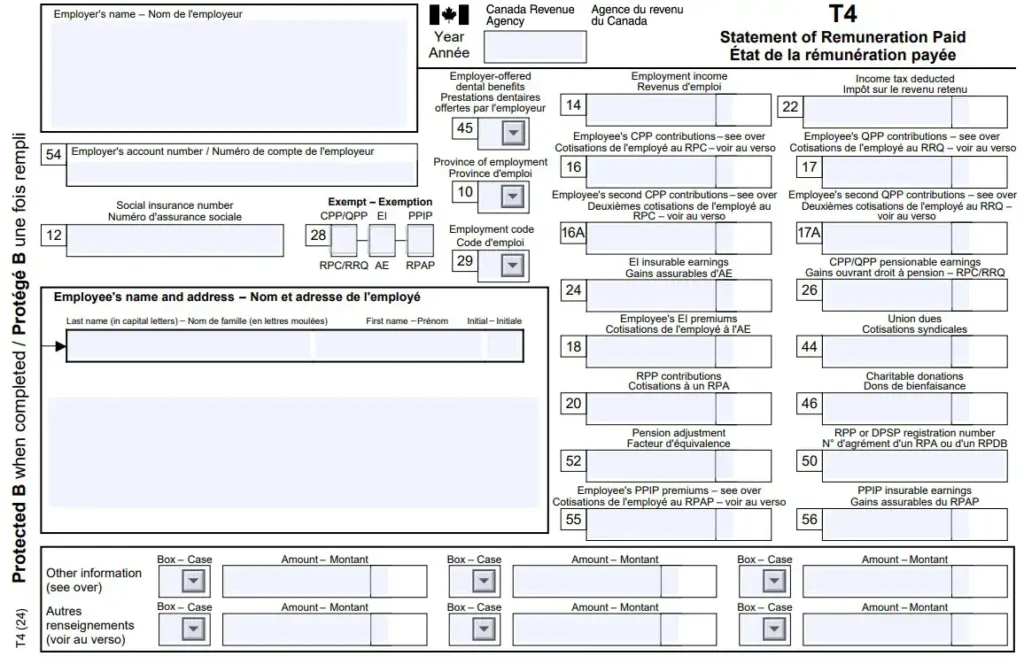

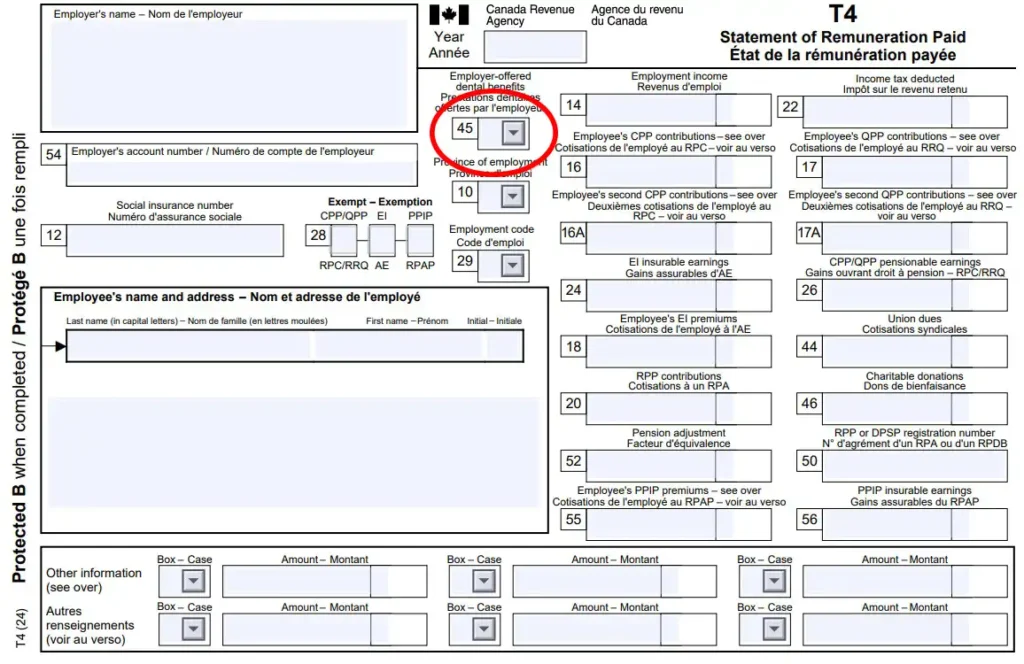

T4 Box 45: Employer-Provided Dental Benefits

- Purpose: This box, titled “Employer-offered dental benefits,” is used to record the specific dental benefit code assigned to each employee. It reflects the type of dental coverage (or lack thereof) available to employees as of December 31 of the tax year.

- Applicability: This reporting requirement applies to all employers, regardless of whether they provide dental benefits.

- Significance: Accurate reporting in T4 Box 45 is critical for facilitating the administration of the Canadian Dental Care Plan (CDCP) and ensuring the Canada Revenue Agency (CRA) processes T4 slips without issues.

T4A Box 015: Payer-Provided Dental Benefits

- Purpose: This box, titled “Payer-offered dental benefits,” is used for individuals receiving income reported on T4A slips, such as pensions or superannuation.

- Mandatory When: Reporting in this box is required if there is an amount in T4A Box 016 (“Pension or Superannuation”).

- Optional Use: If T4A Box 016 is empty, reporting dental benefits in Box 015 is optional, giving flexibility for certain payers.

Mandatory vs. Optional Reporting

Administrative Policy Waiving Code 1 Reporting (2023–2024)

- Policy Overview: To ease the transition into mandatory dental benefits reporting, the CRA introduced an administrative policy waiving the requirement to report Code 1 (“No dental coverage”) for the 2023 and 2024 tax years.

- Implications for Employers: Employers who do not provide dental benefits are not obligated to include this code during the initial implementation phase, reducing the administrative burden.

- Future Requirements: Starting in 2025, reporting will become mandatory for all employers, including those assigning Code 1.

Importance of Accurate Reporting

- Avoiding CRA Rejections: The CRA has strict standards for processing T4 and T4A slips. Errors or omissions in reporting dental benefit codes can result in the rejection of the entire T4 submission, leading to compliance issues and potential penalties.

- Supporting the CDCP: Accurate data enables the government to administer the CDCP effectively, ensuring eligible Canadians receive the dental care they need. Employers’ precise reporting helps identify gaps in dental coverage and directs resources to underserved populations.

- Reputation and Record-Keeping: Accurate reporting not only ensures compliance but also enhances an employer’s reputation for transparency and supports employees in understanding their benefits and tax obligations.

‘Pro-Tip’

Understand Coverage Levels: Review your dental benefit plans thoroughly to determine the exact level of coverage offered to employees. Misclassification can lead to compliance issues.

Breakdown of T4 Dental Benefit Codes

The T4 dental benefit codes provide a standardized way to report the type of dental coverage offered by employers. These codes, ranging from 1 to 5, capture different levels of dental benefits and help the government administer the Canadian Dental Care Plan (CDCP) effectively. Below is a detailed explanation of each code and additional considerations for accurate reporting.

Detailed Explanation of Each Code

Code 1: No Dental Coverage

- Definition: Assigned to employees who do not have access to any form of dental insurance or coverage for dental services of any kind.

- Usage: This code is typically used when no employer-sponsored dental benefits or related Health Care Spending Accounts (HCSA) are provided.

- Administrative Policy: Employers are not required to report this code for the 2023 and 2024 tax years under the CRA’s administrative policy, reducing the initial compliance burden.

Code 2: Limited Dental Coverage for Specific Individuals

- Definition: Represents coverage available only to the employee, with no coverage extended to spouses or dependents.

- Usage Example: An employer offers a basic dental plan that exclusively covers the employee’s dental needs, with no options for family members.

Code 3: Expanded Coverage for Employee and Spouse

- Definition: Indicates dental coverage that extends to the employee and their spouse but excludes dependents.

- Usage Example: An employer provides a mid-tier dental plan covering the employee’s and their spouse’s dental needs but does not include coverage for children or other dependents.

Code 4: Comprehensive Coverage for Employee, Spouse, and Dependents

- Definition: Reflects the most comprehensive level of coverage, including the employee, their spouse, and eligible dependents.

- Usage Example: An employer offers a robust dental plan covering the employee, spouse, and dependent children.

- Special Consideration: Employees without a spouse or dependents would still be assigned Code 4 if the plan allows access to these benefits.

Code 5: Other Coverage

- Definition: Used for scenarios that do not fit neatly into Codes 1–4. This may include partial coverage plans, unique group policies, or other special arrangements.

- Usage Example: An employer offers a hybrid plan with limited HCSA-based dental benefits, or the coverage has restrictions that deviate from traditional plans.

Special Notes

Inclusion of Health Care Spending Accounts (HCSA)

- Health Care Spending Accounts are considered a valid form of dental coverage for reporting purposes.

- If an employee has access to HCSA funds that can be used for dental services, the appropriate dental benefit code should reflect this coverage, even if it is not a traditional insurance plan.

Criteria for Selecting the Correct Code

- As of December 31: The coverage reported must reflect the benefits available to the employee on December 31 of the tax year.

- Plan Accessibility: Codes are determined by the plan’s offerings, not by whether the employee actively uses or enrolls in the plan.

- Uniform Reporting: Employers must apply the same code to all employees with similar coverage, ensuring consistency in reporting.

‘Pro-Tip’

Leverage the Administrative Waiver: Use the 2023–2024 administrative waiver for reporting Code 1 (no dental benefits) as an opportunity to refine your reporting processes before full compliance becomes mandatory in 2025.

Common Dental Expenses and Coverage

The Canadian Dental Care Plan (CDCP) is designed to provide financial support for medically necessary dental services, ensuring that eligible Canadians can access essential oral healthcare. Below is an overview of the types of dental expenses typically covered under the CDCP and notable exclusions.

Medically Necessary Dental Expenses Covered

Routine Dental Care

- Check-ups and Cleanings: Regular visits to the dentist for oral exams and professional cleanings are covered as they are essential for maintaining oral health and preventing more severe dental issues.

- Fillings: Restorative treatments for cavities are included to address tooth decay and prevent further complications.

Prosthetic Solutions

- Dentures: Both full and partial dentures are eligible for coverage, ensuring that individuals who have lost teeth can regain functionality and improve their oral health.

- Dental Implants: Implants, which serve as a long-term solution for tooth loss, are considered medically necessary and covered under the plan.

Other Necessary Treatments

- Procedures deemed essential for oral health, such as extractions and certain periodontal treatments, may also be covered based on individual circumstances.

Exclusions

Cosmetic Procedures

- Treatments performed purely for aesthetic enhancement, such as teeth whitening or veneers, are not covered under the CDCP. These procedures do not address medical or functional dental needs and are therefore outside the program’s scope.

Non-Medically Necessary Services

- Optional services or procedures without a direct link to oral health, such as elective cosmetic bonding or decorative dental enhancements, are excluded.

‘Pro-Tip’

Standardize Reporting: Develop a consistent method for assigning codes based on eligibility as of December 31 each year. Uniform practices reduce errors and ensure CRA acceptance.

Tax Implications of Dental Benefits

The tax treatment of dental benefits in Canada varies depending on the source of coverage and the nature of the expenses incurred. Understanding these implications is essential for both employers and employees to maximize tax efficiency and comply with reporting requirements.

Employer-Paid Premiums

Tax Treatment of Private Health Services Plans (PHSPs):

- Employer-paid premiums for private health services plans, including dental benefits, are not taxable to employees. This means that employees do not have to include these amounts in their income for tax purposes.

- Employers can deduct these premiums as a business expense, providing a tax-efficient way to offer benefits.

Tax-Free Nature of CDCP Benefits:

- Dental care benefits provided under the Canadian Dental Care Plan (CDCP) are tax-free for recipients. Individuals who receive CDCP benefits do not need to report them as income, ensuring that the program’s financial assistance is not diminished by tax obligations.

Medical Expense Tax Credit (METC)

The Medical Expense Tax Credit (METC) allows individuals to claim eligible out-of-pocket medical expenses, including dental costs, as a non-refundable tax credit. Here’s a detailed breakdown:

Eligibility:

- Out-of-pocket dental expenses not covered by insurance or the CDCP can be claimed under the METC.

- Eligible expenses must be paid within a 12-month period ending in the tax year for which the credit is claimed.

Process for Claiming the METC:

- Complete the relevant section on the T1 Income Tax and Benefit Return to report medical expenses.

- Include all eligible dental costs, such as routine care, dentures, and medically necessary procedures, in the total.

Deductible Amounts:

- The claimable amount is calculated by subtracting the lesser of:

- $2,479 (for the 2023 tax year, indexed annually); or

- 3% of the individual’s net income.

- Any amount exceeding this threshold qualifies for the tax credit.

- The claimable amount is calculated by subtracting the lesser of:

Required Documentation:

- Keep receipts for all eligible dental expenses, as these may be required by the Canada Revenue Agency (CRA) for verification.

- If employer-paid premiums are reported under Code 85 on the T4 slip, employees can use this documentation to substantiate their claims for the METC.

‘Pro-Tip’

Include HCSAs: If employees have access to a Health Care Spending Account (HCSA) that covers dental expenses, ensure it’s reflected in the assigned dental benefit code.

Application Process for the Canadian Dental Care Plan (CDCP)

The Canadian Dental Care Plan (CDCP) is designed to provide dental coverage to eligible Canadians without private dental insurance. The application process ensures that only qualified individuals receive benefits, maintaining the program’s integrity and efficiency. Here’s a step-by-step guide to navigating the application process:

Step 1: Receiving an Invitational Letter

- Eligibility Identification:

- Eligible individuals are identified based on their family net income and lack of private dental insurance.

- The Canada Revenue Agency (CRA) or Service Canada sends an invitational letter to those who meet the criteria.

- Contents of the Letter:

- The letter includes a unique application code required for the next step.

- Additional details outline the eligibility requirements and instructions for completing the application.

Step 2: Application via Phone

- Phone Application Process:

- Applicants must call the Service Canada number provided in the letter to begin the application process.

- During the call, individuals will need to:

- Provide their unique application code.

- Confirm personal and financial details to validate eligibility.

- Applicants may also be asked to supply supporting documentation if required.

- Confirmation from Service Canada:

- Once the application is processed, applicants will receive a confirmation of their status (approved or denied).

- Approval is typically contingent on meeting all eligibility criteria, including income thresholds and lack of private dental coverage.

Step 3: Welcome Package and ID Card Issuance

- Welcome Package:

- Approved applicants receive a welcome package in the mail, usually from Sun Life or another designated CDCP partner.

- The package includes:

- A coverage start date.

- Details about the plan’s benefits.

- Instructions on how to access dental services.

- ID Card Issuance:

- A personalized ID card is included in the welcome package, allowing individuals to verify their coverage at dental clinics.

Ensuring Eligibility Through the Process

- Pre-screening by Invitation Only:

- The invitational letter ensures that only individuals meeting preliminary criteria are invited to apply, reducing ineligible applications.

- Validation During Application:

- Service Canada verifies all applicant-provided information, including income levels and insurance status, to confirm eligibility.

- Controlled Access to Benefits:

- By requiring an ID card for coverage, the CDCP ensures that benefits are used exclusively by eligible individuals.

‘Pro-Tip’

Train Payroll Teams: Invest in training your HR and payroll staff to understand T4 dental benefit codes and their implications for accurate reporting.

Examples of T4 Dental Benefit Code Usage

To understand how T4 dental benefit codes are applied, it’s helpful to explore real-world scenarios that demonstrate the practical use of these codes. Below are examples illustrating common situations for employers and employees.

Example 1: Code 1 – No Dental Benefits

- Scenario:

- A small business with five employees does not offer any employer-sponsored dental insurance or coverage, either directly or through a Health Care Spending Account (HCSA).

- Code Application:

- The employer assigns Code 1 to all employees, indicating that there is no access to any dental benefits.

- Key Notes:

- For the 2023 and 2024 tax years, reporting Code 1 is optional due to the CRA’s administrative policy. However, starting in 2025, the employer must include this information on the T4 slips.

Example 2: Code 4 – Comprehensive Coverage

- Scenario:

- A large corporation provides a comprehensive dental benefits plan that covers the employee, their spouse, and all eligible dependents.

- The plan includes coverage for routine check-ups, cleanings, fillings, dentures, and other medically necessary procedures.

- Code Application:

- All employees are assigned Code 4, regardless of whether they have a spouse or dependents. The code reflects the maximum level of coverage that the plan offers, even if an individual employee does not fully utilize the benefits.

- Key Notes:

- The code is based on the availability of coverage as of December 31 of the tax year, not the employee’s actual usage of the plan.

Example 3: Mixed Code Application in a Diverse Workforce

- Scenario:

- An employer offers tiered dental plans based on employee roles:

- Entry-level employees receive basic dental coverage for themselves only (Code 2).

- Mid-level employees receive coverage for themselves and their spouses (Code 3).

- Senior-level employees receive full coverage for themselves, their spouses, and dependents (Code 4).

- An employer offers tiered dental plans based on employee roles:

- Code Application:

- Employees are assigned codes based on the plan they are eligible for on December 31. For instance:

- An entry-level employee: Code 2.

- A mid-level employee: Code 3.

- A senior-level employee: Code 4.

- Employees are assigned codes based on the plan they are eligible for on December 31. For instance:

- Key Notes:

- Employers must ensure consistency in assigning codes based on plan eligibility, not personal circumstances (e.g., whether an employee actually has a spouse or dependents).

‘Pro-Tip’

Use Payroll Software: Upgrade to payroll software that supports T4 dental benefit code reporting to minimize errors and streamline compliance.

Challenges and Considerations for Employers

The introduction of T4 dental benefit codes presents both immediate challenges and long-term benefits for employers. Understanding these factors is key to navigating the transition smoothly and leveraging the advantages of accurate reporting.

Initial Implementation Hurdles

Complexity in Selecting Correct Codes

- Employers face the challenge of accurately determining the appropriate dental benefit code for each employee. This involves:

- Reviewing the specifics of each benefit plan.

- Considering non-traditional coverage options, such as Health Care Spending Accounts (HCSAs).

- Ensuring the code reflects the benefits available as of December 31, regardless of actual utilization by employees.

- Misclassification can lead to CRA rejection of T4 slips, compliance issues, and potential penalties.

- Employers face the challenge of accurately determining the appropriate dental benefit code for each employee. This involves:

Adjustments for Future Mandatory Reporting

- The CRA has provided an administrative waiver for reporting Code 1 (no dental benefits) in the 2023 and 2024 tax years to reduce the initial burden. However, starting in 2025:

- All employers will be required to report dental benefit codes, including Code 1.

- Employers must adapt their payroll and HR systems to accommodate the mandatory reporting of all codes.

- Preparation and process refinement during the transitional period are crucial to avoid disruptions once full compliance is required.

- The CRA has provided an administrative waiver for reporting Code 1 (no dental benefits) in the 2023 and 2024 tax years to reduce the initial burden. However, starting in 2025:

Long-Term Benefits

Streamlined Compliance

- Once employers establish robust processes for determining and reporting dental benefit codes:

- Compliance with CRA regulations becomes seamless.

- Accurate reporting reduces the risk of audits, penalties, and administrative errors.

- Centralized systems and training for HR/payroll teams can further simplify ongoing compliance efforts.

- Once employers establish robust processes for determining and reporting dental benefit codes:

Enhanced Data for CDCP Effectiveness

- The data collected through T4 reporting enables the government to:

- Identify gaps in dental coverage across different regions and industries.

- Allocate resources for the Canadian Dental Care Plan (CDCP) more effectively.

- Employers contribute to a national initiative that ensures dental care reaches Canadians who need it most.

- Participating in this reporting process also reinforces an employer’s commitment to transparency and social responsibility.

- The data collected through T4 reporting enables the government to:

‘Pro-Tip’

Prepare for Mandatory Reporting: Begin including Code 1 reporting in your systems now, even if it’s optional, to avoid last-minute challenges in 2025.

Frequently Asked Questions (FAQ)

What are T4 dental benefit codes?

T4 dental benefit codes are numerical identifiers introduced by the Canadian government to report the type and level of employer-sponsored dental benefits provided to employees. These codes are included on T4 slips to help administer the Canadian Dental Care Plan (CDCP) effectively.

Why were T4 dental benefit codes introduced?

The codes were introduced to collect data on employer-sponsored dental benefits, enabling the government to identify gaps in coverage and determine eligibility for the CDCP. This initiative supports the broader goal of improving dental care accessibility for Canadians who lack private insurance.

What do the T4 dental benefit codes mean?

Each code corresponds to a specific level of dental coverage:

- Code 1: No dental coverage.

- Code 2: Coverage for the employee only.

- Code 3: Coverage for the employee and their spouse.

- Code 4: Coverage for the employee, their spouse, and dependents.

- Code 5: Other forms of coverage that do not fit into Codes 1–4.

Who needs to report T4 dental benefit codes?

All employers must report dental benefit codes on T4 slips for their employees. This requirement applies even if no dental benefits are offered (Code 1). However, the CRA has waived the need to report Code 1 for the 2023 and 2024 tax years to ease the transition.

What if my organization does not offer dental benefits?

If no dental benefits are provided, employers should assign Code 1 to employees. For 2023 and 2024, reporting Code 1 is optional under the CRA’s administrative policy, but it will become mandatory starting in 2025.

What are Health Care Spending Accounts (HCSAs), and how do they affect reporting?

HCSAs are flexible benefit accounts that employees can use to cover various medical and dental expenses. If an HCSA is available to employees and can be used for dental services, employers must assign a dental benefit code (e.g., Code 2–4), even if the HCSA is the only form of coverage provided.

How are T4 dental benefit codes determined?

The code is based on the benefits available to the employee on December 31 of the tax year. It reflects the highest level of coverage offered, regardless of whether the employee utilized the benefits or has eligible dependents.

What happens if I report the wrong code?

Incorrect reporting may result in:

- The rejection of T4 slips by the CRA.

- Potential fines or penalties for non-compliance.

- Delays in tax filing or eligibility assessment for the CDCP.

Employers should review their benefits plans carefully and consult with payroll professionals to ensure accuracy.

Are employer-paid dental premiums taxable to employees?

No, employer-paid premiums for private health services plans, including dental benefits, are not taxable to employees. Similarly, benefits received under the CDCP are tax-free.

Can employees claim out-of-pocket dental expenses on their taxes?

Yes, employees can claim eligible out-of-pocket dental expenses as a non-refundable tax credit through the Medical Expense Tax Credit (METC). These include expenses not covered by insurance or the CDCP.

How do T4 dental benefit codes interact with the CDCP?

The codes help the government identify which employees already have dental coverage and which do not. This information ensures that CDCP resources are directed to eligible individuals who lack private insurance.

What steps should employers take to prepare for mandatory reporting?

Employers should:

- Review their dental benefit plans to understand the coverage provided.

- Train HR and payroll teams on selecting the correct codes.

- Update payroll systems to accommodate T4 dental benefit codes.

- Communicate with employees about the purpose of the reporting.

Does the CDCP cover all dental expenses?

No, the CDCP only covers medically necessary dental services, such as cleanings, fillings, dentures, and implants. Cosmetic procedures, like teeth whitening, are excluded.

How can I apply for the CDCP?

Eligible individuals must wait for an invitational letter from the government. Applications are completed over the phone, and approved applicants receive a welcome package with an ID card to access coverage.

Where can I find more information about T4 dental benefit codes?

For more information, consult:

- The CRA’s official website.

- Your payroll service provider or HR professional.

- Legal or tax advisors specializing in employee benefits.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.